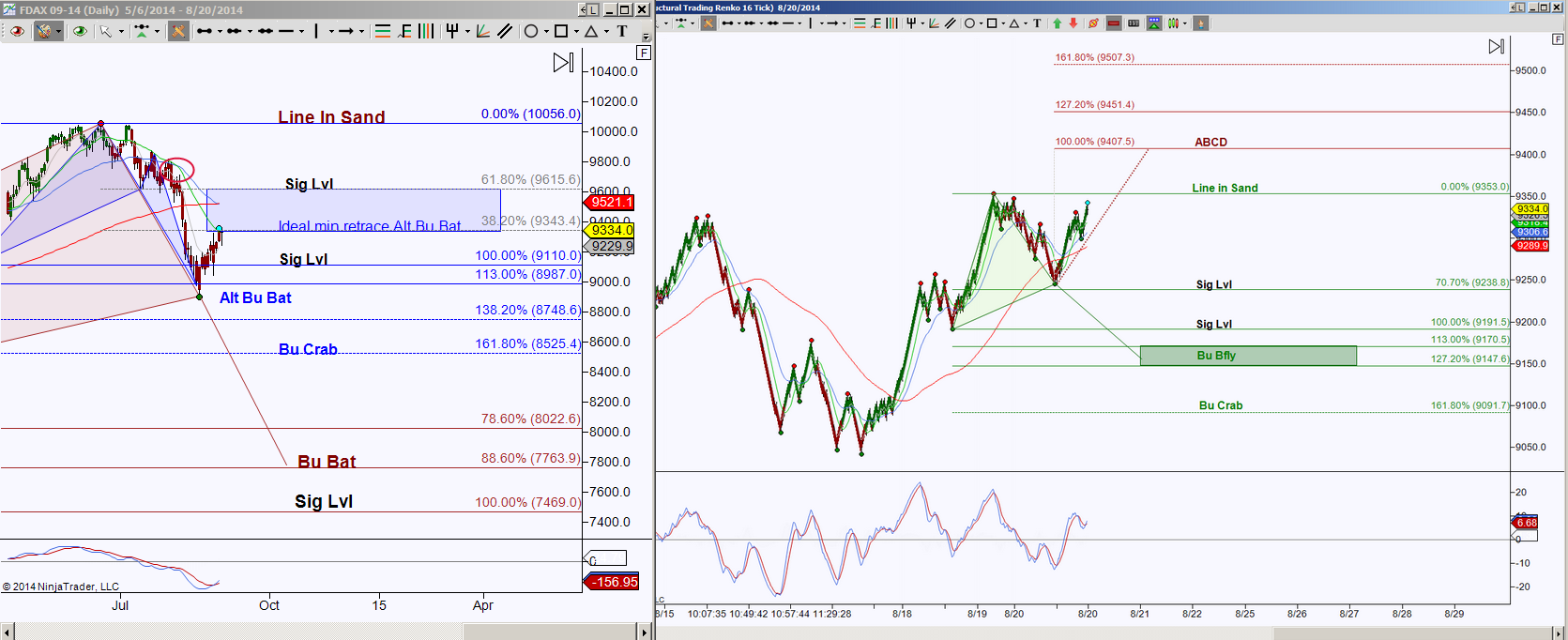

DAX is currently in retracement mode of a small bullish harmonic pattern inside a larger emerging pattern. What this boils down to is a completion of an Alternate Bullish Bat created a bounce point to form a required leg for the larger emerging pattern, which the minimum for this leg is at 9343.5 and the maximum this leg can go, to remain this particular pattern valid, is 10056.

The left side of the chart is the day bar size and the right side is an intraday perspective, in this case I’m using an STRenko 16 Bar size. The day chart shows price in retracement mode of the Alternate Bullish Bat and is currently testing the ideal minimum retracement target, this correlates with a bearish cross validation, which defines a downside bias, so a hold at this correlating level of 9343.5 offers a short opportunity.

The STR12 chart shows price is in between opposing emerging patterns with the line in the sand level at 9353. Above this level invalidates the green colored emerging Butterfly and a hold above 9353 has ABCD targets at 9407.5, 9451.5 and 9507.5.

A hold below 9353 correlates with a hold below the day chart’s 9343.5 retracement target and implies a retest of 8987 with initial support test targets at 9306.5 and 9290.

The bigger picture is price has a downside bias with bounces into resistance scenario, the intraday view is approaching a decisive point at 9353. The overall bias remains to the downside until proven otherwise and that scenario increases in probability with a hold above 9521.

The intraday perspective offers long opportunities to 9353, then above there the ABCD targets as shown on the chart. Remember price is bouncing into resistance on the larger view so be prepared to take or protect profits at targets or be willing to exit the trade. Once price holds below 9343.5, whether now or later, increases the probability of stating that leg is complete and onto the final journey with ideal targets at 8525.5 and 7764 on the larger moves and 9147.5 and 9092 on the intraday moves.