Implied Volatility for Iron Condors

2/15

Intraday moment on using OptionDawg entry signals together with Harmonic rotations, click here for video

2/4/2013

Intraday moment on Ratio and Back Ratio Earnings Strategy, click here for video

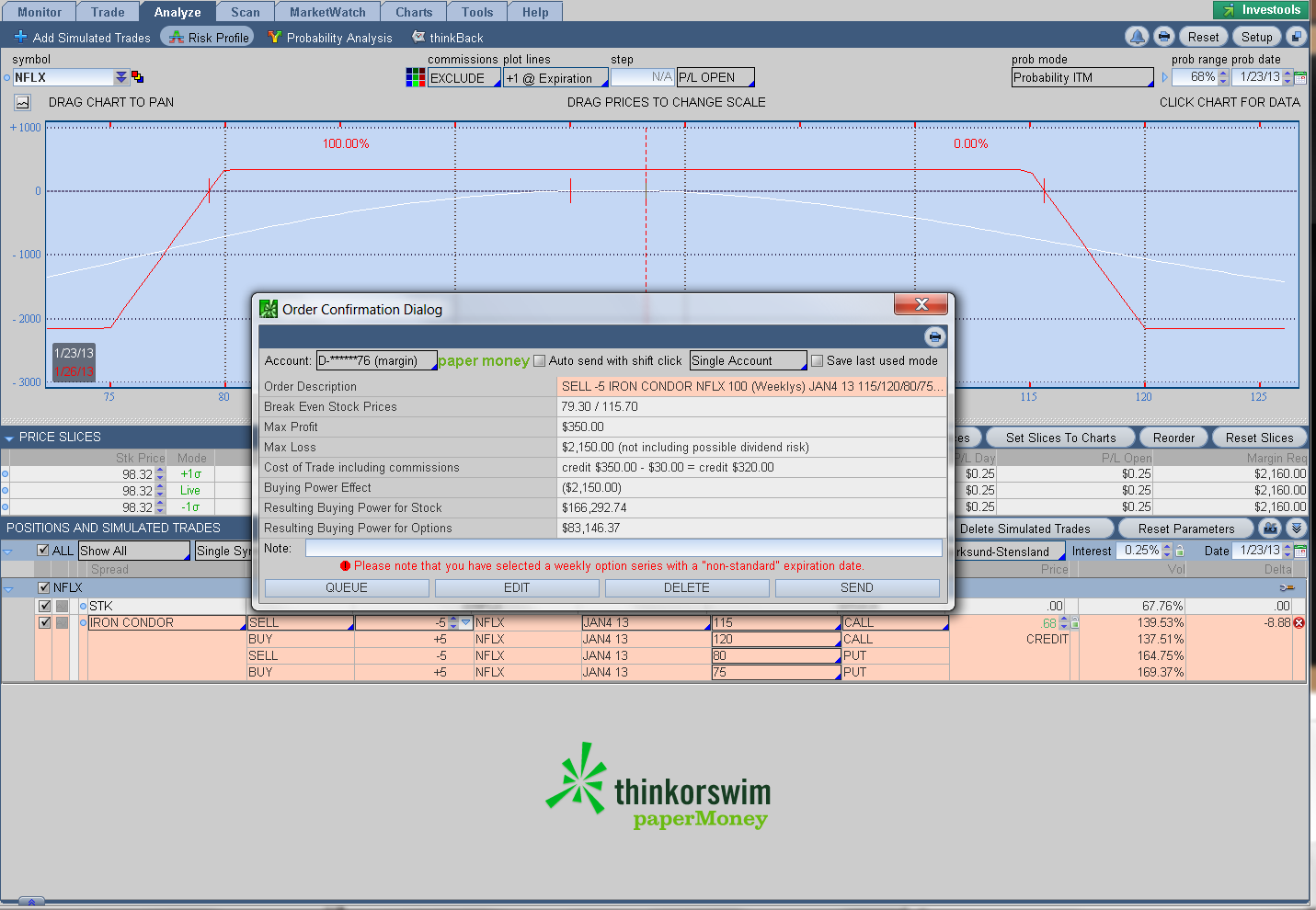

1/23/2013

NFLX EARNINGS TRADE

WORDS OF WISDOM

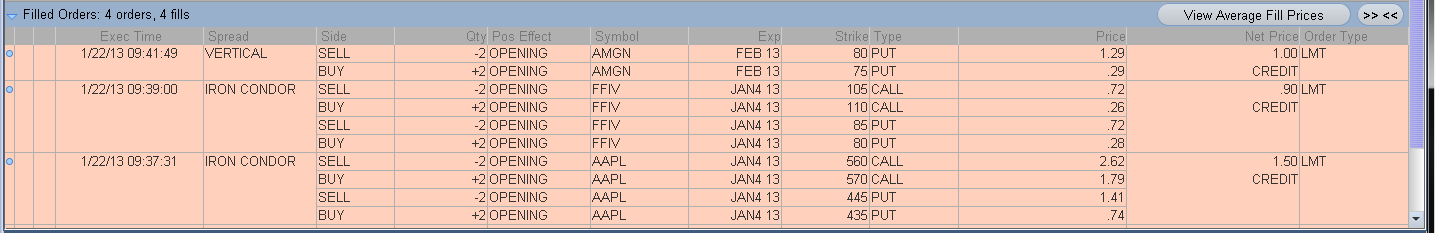

1/22/2013

TRADE IDEAS

AMGN Bull PUT SPREAD

Quantity: 2 Put CREDIT Verticals

Sell to Open Feb13 80 Put

Buy to Open Feb13 75 Put

Credit is 1.00 with a plan to close at 50-60% of credit minimum and a stop of 1.5x credit or $2.50 each.

FFIV IRON CONDOR

Quantity: 2 Iron Condors (4 legs) WEEKLY

Put Spread

Sell to Open Jan13 (3) 85 Put

Buy to Open Jan13 (3) 80 Put

Call Spread

Sell to Open Jan13 (3) 105 Call

Buy to Open Jan13 (3) 110 Call

Limit order: $1.80 credit ($.90 x2)

Order type: Day

Trade plan: We will look to open 2 Iron Condors in FFIV on the JAN13 (3) weekly expiration cycle for a net credit of $180 ($.90 per iron condor X 2). The risk per iron condor is $4.10 for a maximum return on risk of 35% if held through expiration. The maximum risk is $8.20 ($10 – $1.80).

Adjustment and closing criteria:

Spreads will be Closed Wednesday morning following the earnings announcement. A nice conservative target is 50-60% of credit or $90-110.

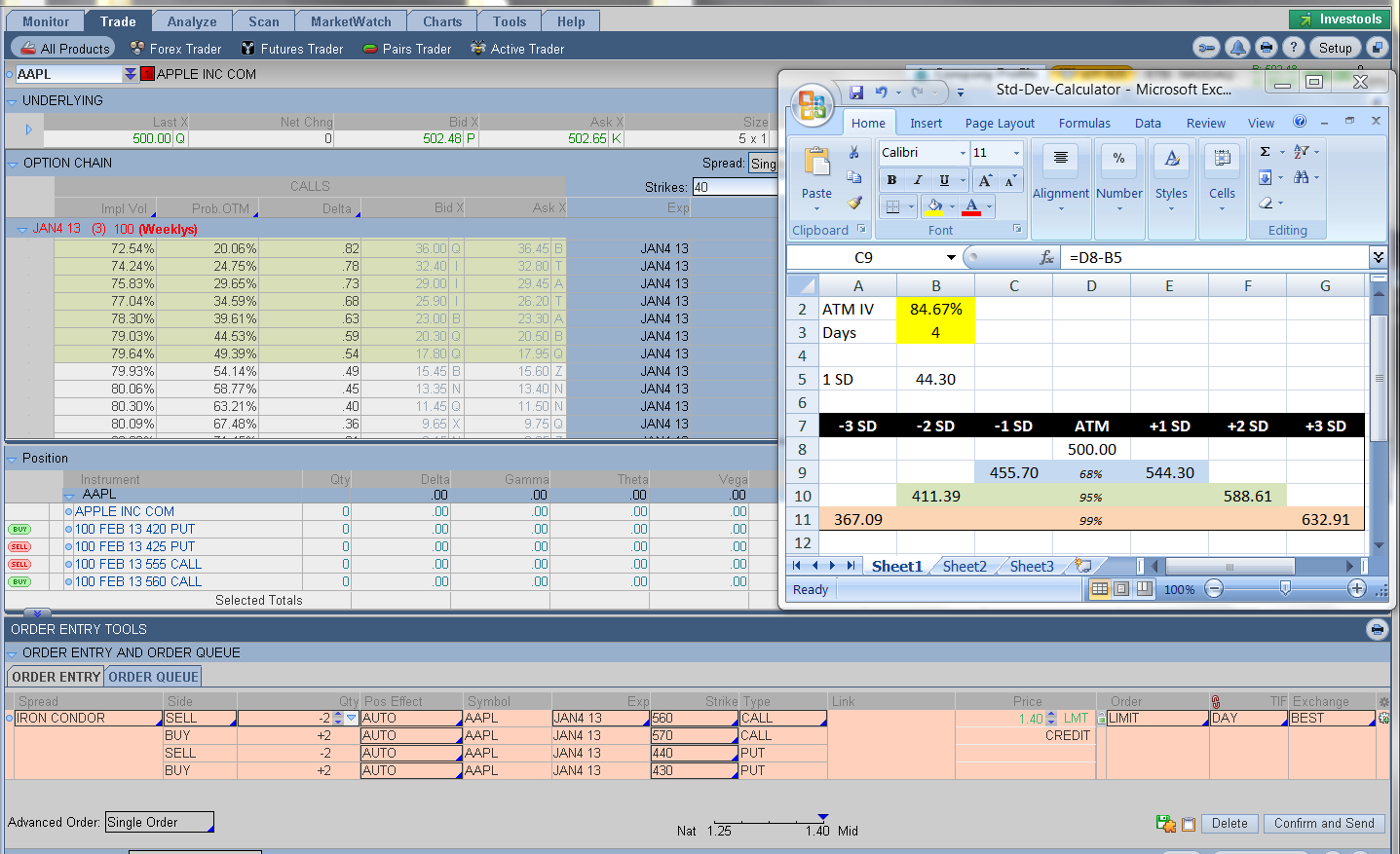

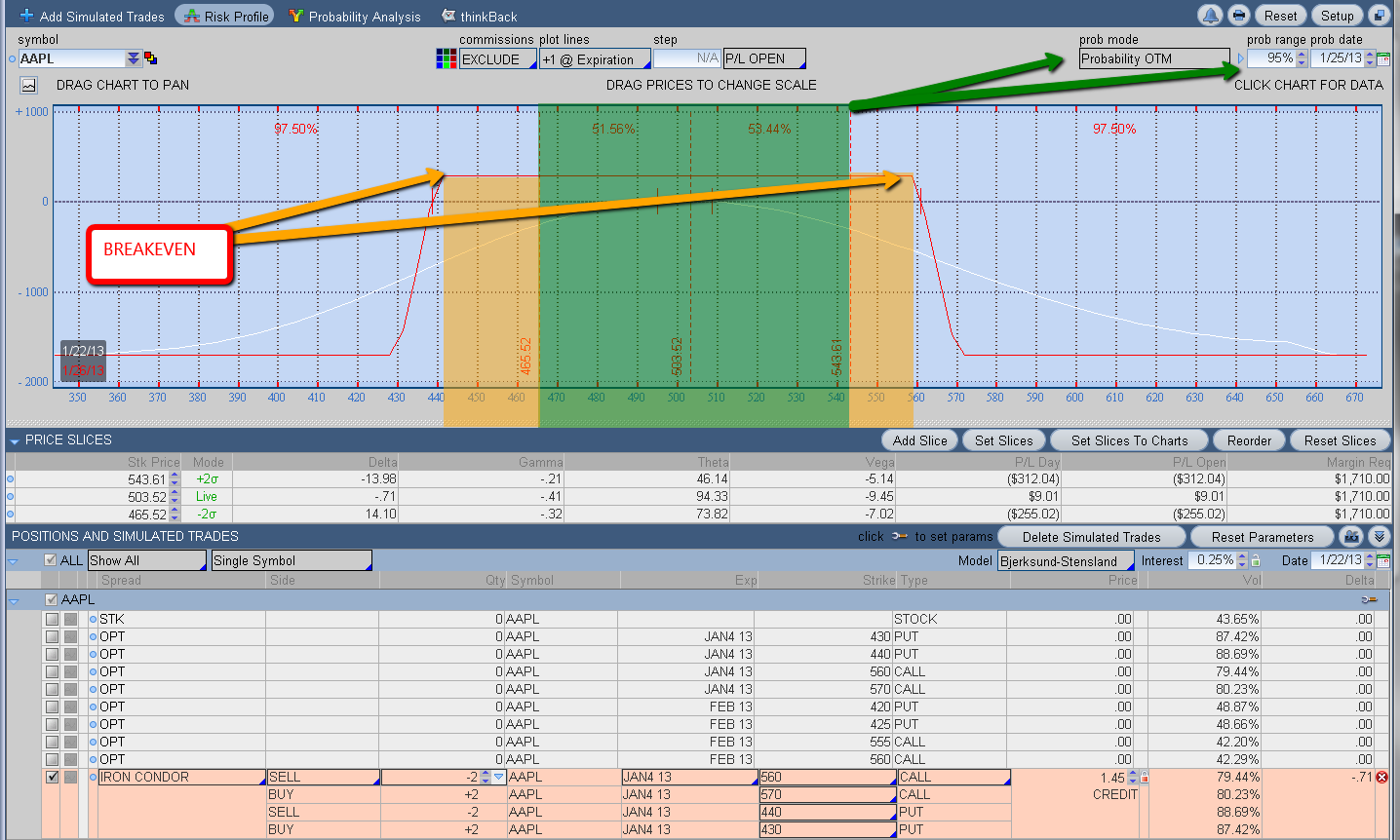

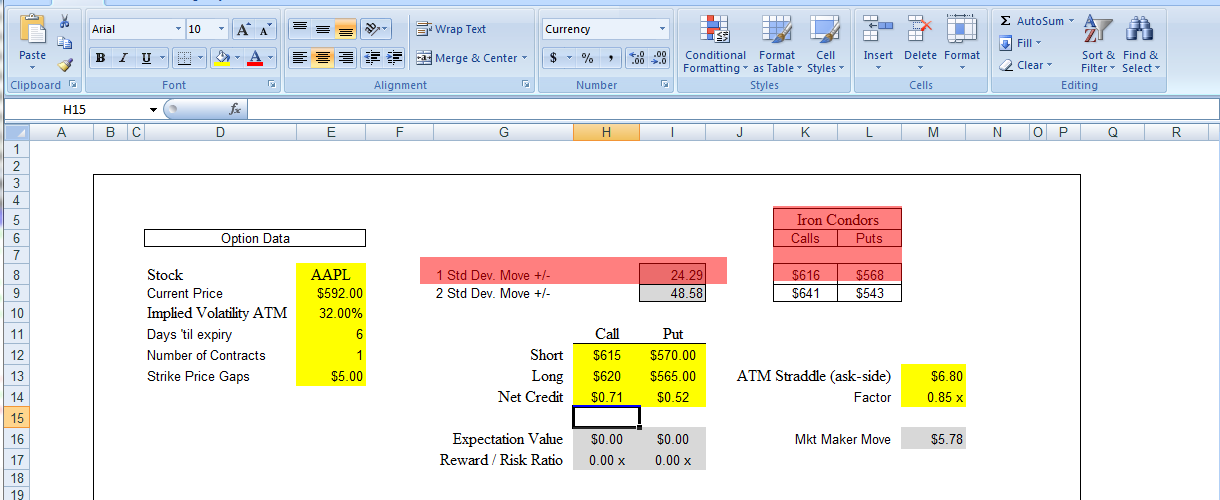

AAPL IRON CONDOR

***NOTE-ADJ put leg up $ to account for opening.

Underlying: AAPL (APPLE) Expiration Cycle: JAN 2013 (3) WEEKLY

Quantity: 2 Iron Condors (4 legs)

Put Spread

Sell to Open Feb13 445 Put

Buy to Open Feb13 435 Put

Call Spread

Sell to Open Feb13 560 Call

Buy to Open Feb13 570 Call

Limit order: $1.50 credit ($3.00 total)

Order type: Day

Trade plan: We will look to open 2 Iron Condors in AAPL for the JAN13 (3) weekly expiration cycle for a net credit of $300 ($1.50 per iron condor X 2). The risk per iron condor is $3.00 for a maximum return on risk of 43% if held through expiration. The maximum risk is $7.00 ($10 – $3.00).

The current market pricing for the spread is $1.50 mid, $1.35 nat. To increase the odds of filling the order, we suggest a credit limit of $1.50 as AAPL is liquid.

Adjustment and closing criteria:

Spreads will be Closed Wednesday morning following the earnings announcement. A nice conservative target is 50-60% of credit or $150-180.

Account implications:

Net margin requirements: $1400

Total margin requirements: $2000

Stop loss for the position is to CLOSE WEDNESDAY AFTER EARNINGS with a max STOP of $3.25 PER CONDOR.

Technical considerations:

– Current implied volatility IS 2X to historical vol

– Nearly delta neutral with strikes even placed relative to the underlying

– earnings play

1/17/2013

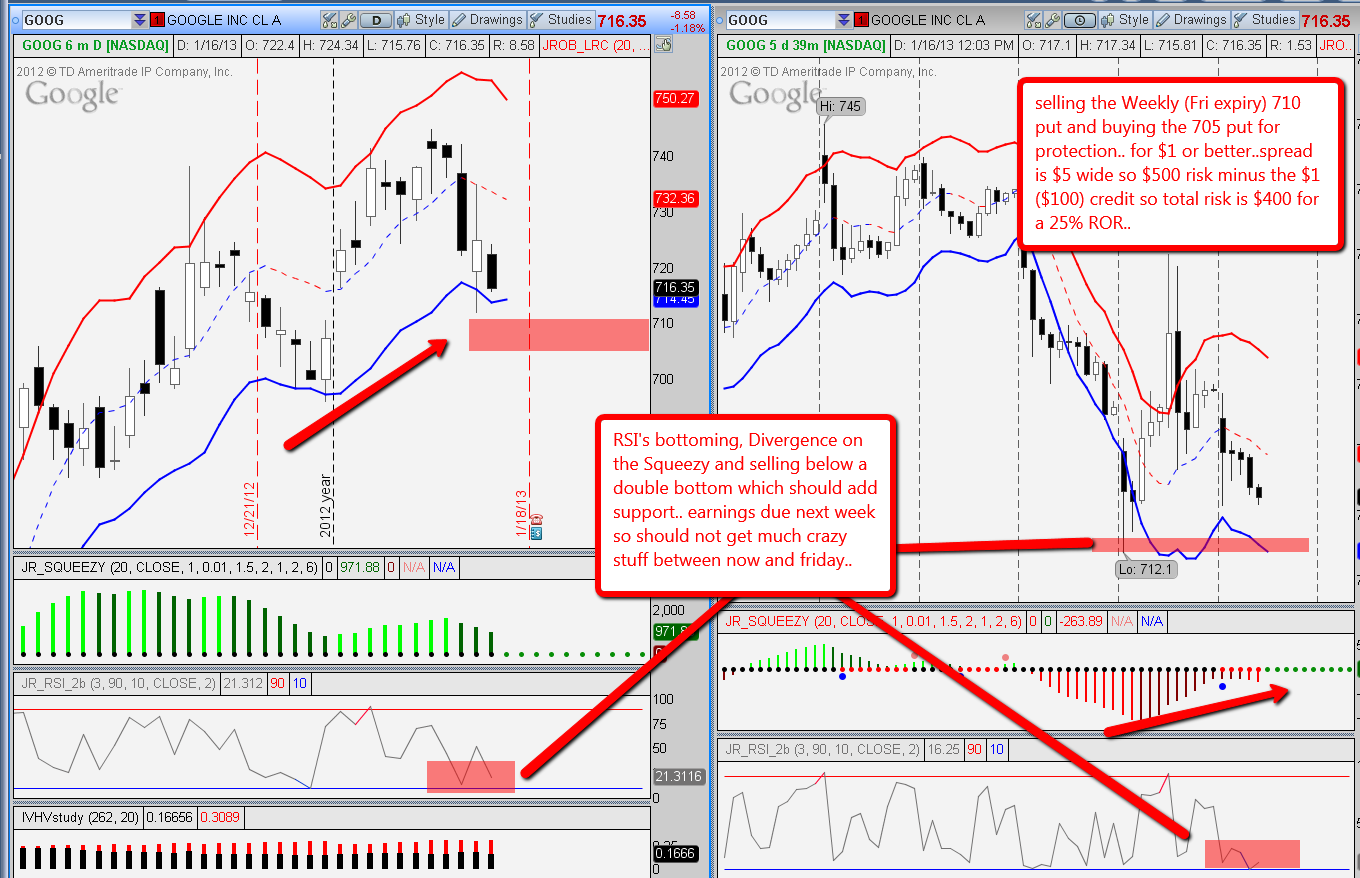

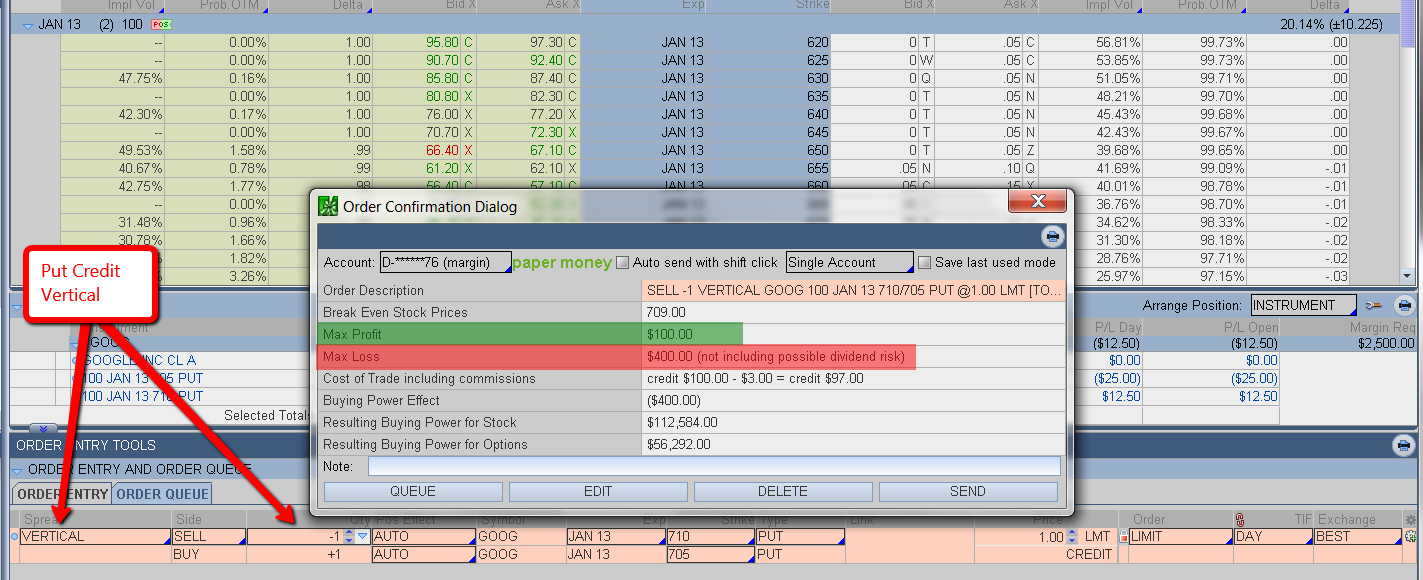

Quick update.. EBAY EARNINGS WAS A 100% WIN..wrong on direction BUT still made a nice profit..put it on for .15 and closed it for .02 ALSO, the GOOG Put vertical spread was opened for 1.40 see below and closed this morning for .30..do the math..:)

1/16/2013

Earning trade idea

EBAY Earnings plays per Jerry example

NEW TRADE IDEA

Trade plan:

We will look to open 2 Vertical Put CREDIT Spreads in Goog for the WEEKLY Jan13(2) expiration cycle for a net credit of $280 ($1.40 per Vertical Put Spread X 2).

The risk per Put Vertical Spread is $4 for a maximum return on risk of 25% if held through expiration. The maximum risk is $7.20 ($10 – $2.80).

The current market pricing for the spread is $1.40 mid, $1.20 nat. To increase the odds of filling the order, I suggest a credit limit of $1.25-1.40

Adjustment and closing criteria:

An additional Spread will be sold at 1 std dev out if Goog touches the short strike, assuming sufficient time remaining before expiration OR you may wish to use the straight stop loss to close original and establish the new spread alone.

**NOTE: THIS IS A WEEKLY OPTION SPREAD AND SUBJECT TO GAMMA RISK AND WILL BE MANAGED AGGRESSIVELY

Account implications:

Net margin requirements: $720

Total margin requirements: $1000

Stop loss for the position is 4.00 (slightly less than double the original credit) for a maximum loss of $400 for the 2 Spreads.

Technical considerations:

– Current implied volatility equivalent to historical vol

– upcoming earnings so should be a rather quite couple days leading up to

– Approaching classic DB on 39m chart @ 712 which should provide additional support

– Short put is outside our LR Channel AND price is currently riding the lower band

– OVERSOLD RSI

1/16/2013

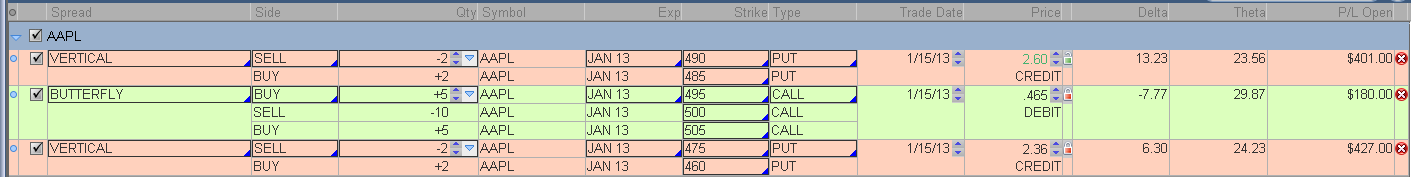

Quick update…took a little heat in AAPL but having faith in both the probabilities and Kathy’s PATTERN ANALYSIS worked out..as planned when we hit 490, I added another fly and pulled both off this morning for this…

1/15/2013

NEW TRADE IDEA:

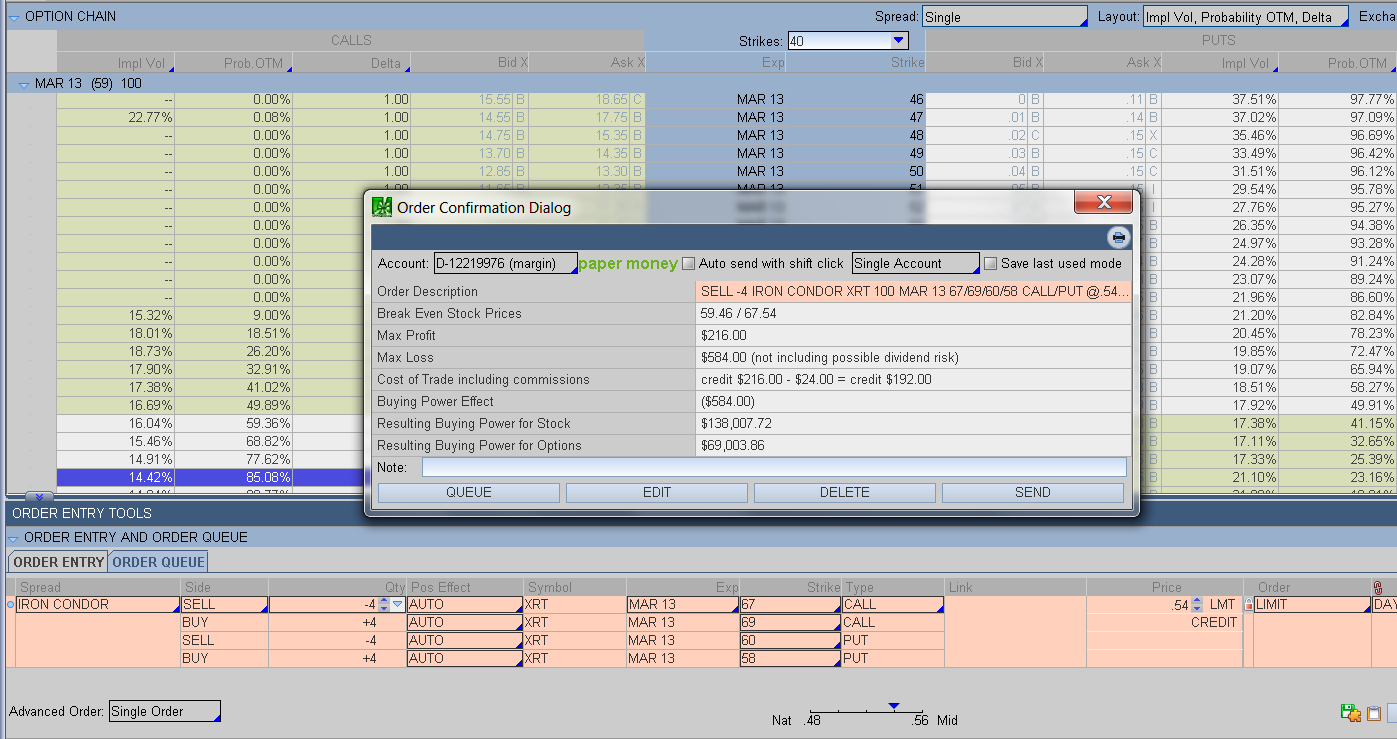

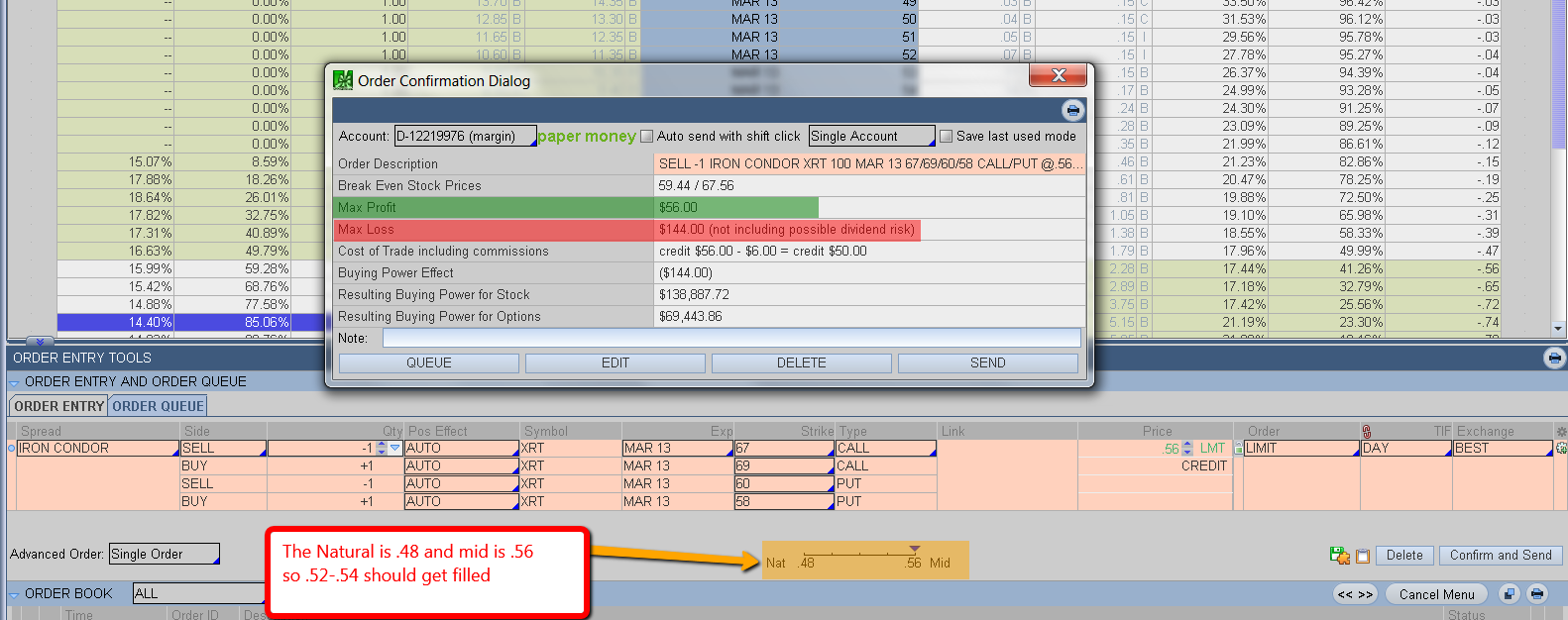

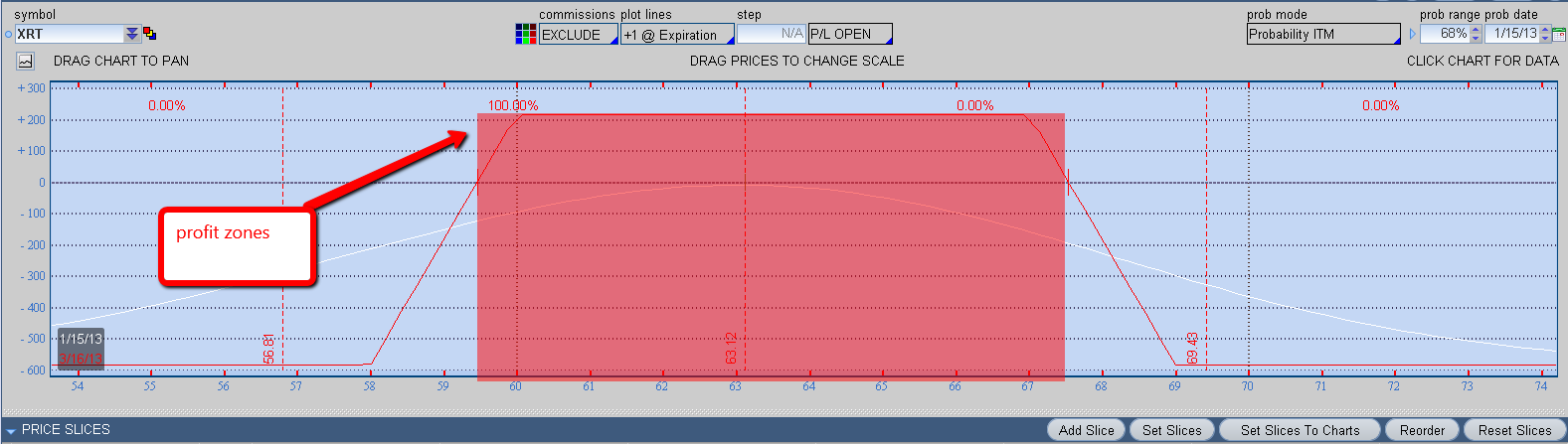

Underlying: XRT (SPDR S&P Retail ETF)

Expiration Cycle: March 2013

Quantity: 4 Iron Condors (4 legs)

Put Spread

Sell to Open Mar13 60 Put

Buy to Open Mar13 58 Put

Call Spread

Sell to Open Mar13 67 Call

Buy to Open Mar13 69 Call

Limit order: $.54 credit

Order type: Day

Trade plan:

We will look to open 4 Iron Condors in the XRT ETF for the March 2013 expiration cycle for a net credit of $216 ($.54 per iron condor X 4).

The risk per iron condor is $1.46 for a maximum return on risk of 35% if held through expiration. The maximum risk is $5.84 ($8 – $2.16).

The current market pricing for the spread is $.56 mid, $.48 nat. To increase the odds of filling the order, we suggest a credit limit of $.54.

Adjustment and closing criteria:

Spreads will be rolled up/down as needed if XRT touches one of the short strikes, assuming sufficient time remaining before expiration and the debit for the roll is $.26 or less.

Account implications:

Net margin requirements: $584

Total margin requirements: $800

Stop loss for the position is $.65 (slightly double the original credit) for a maximum loss of $260 for the 4 iron condors.

Technical considerations:

– Current implied volatility equivalent to historical vol

– Nearly delta neutral with strikes even placed relative to the underlying

–

– Short put is outside our LR Channel AND price is currently riding the mid band S

– Neutral RSI

01/14/2013

Using Harmonics and OptionsDawg to construct a trade…

Day trades can be accomplished selling premium as well..

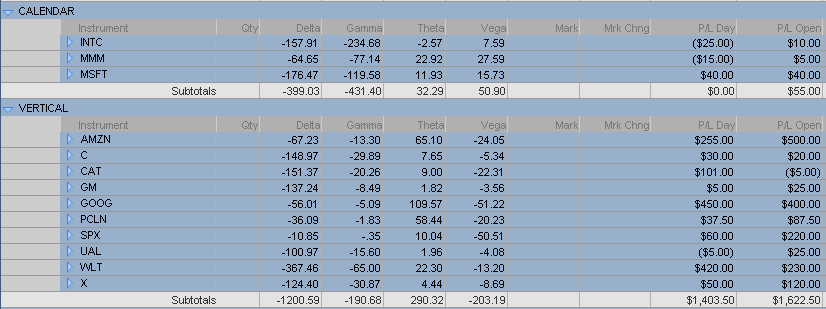

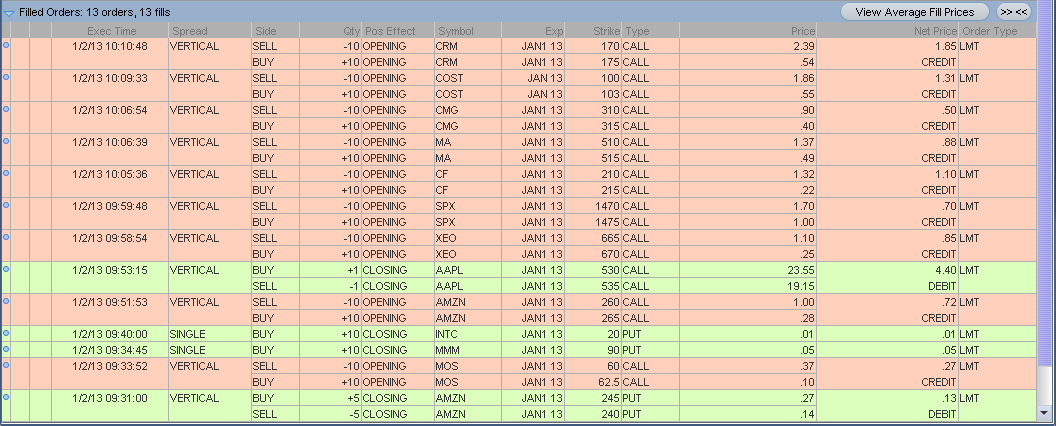

Trades from Monday using the indicators and scans provided from 1/2/2013 video..

Earnings example as well…

1/2/2013 Intraday presentation on personal indicators used in TOS, click here for video

1//2/2013

Taking advantage of the Gap open and weeklies!

my chart space..

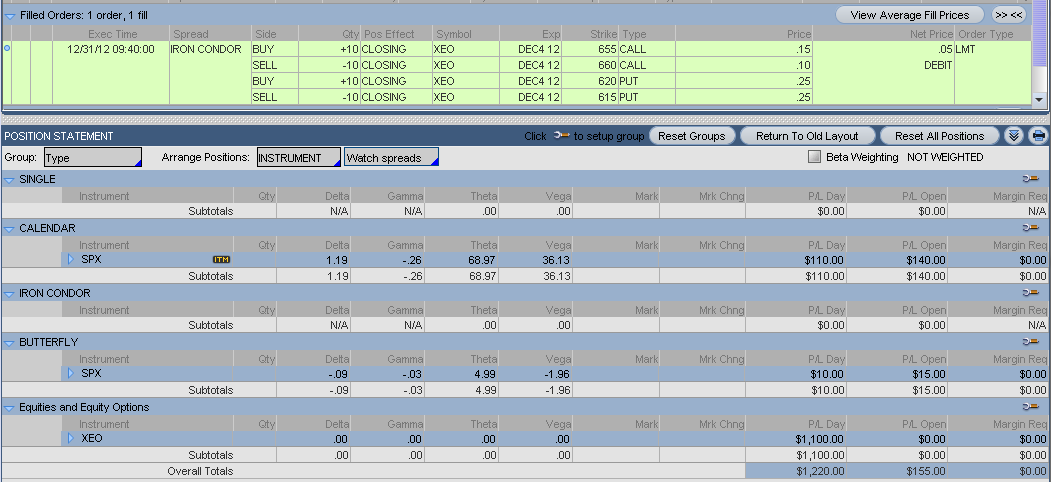

12/31/2012 Intraday presentation on Calendar Spreads, Linear Regression Curve & Volume Profile, click here for video

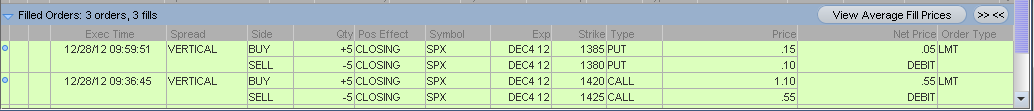

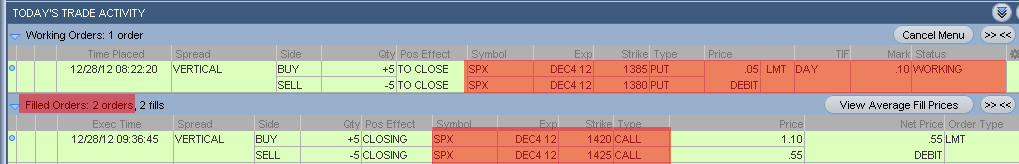

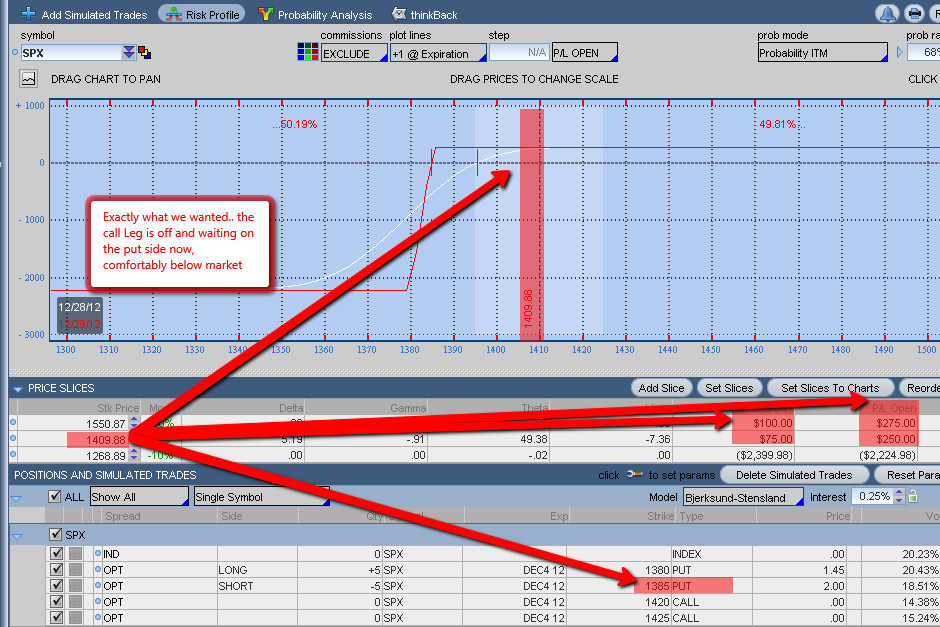

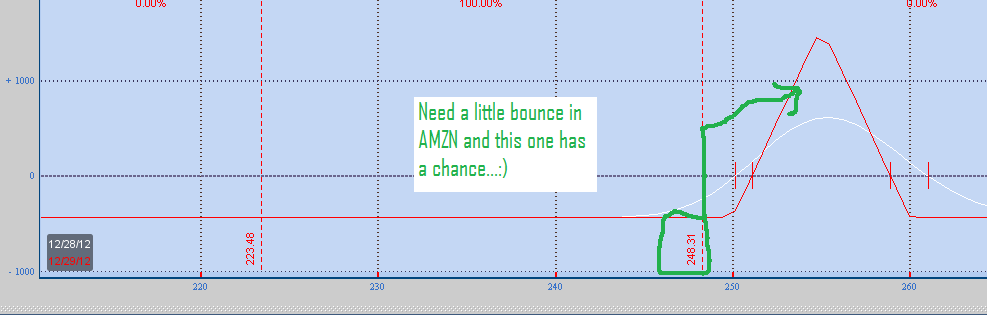

12/28/2012

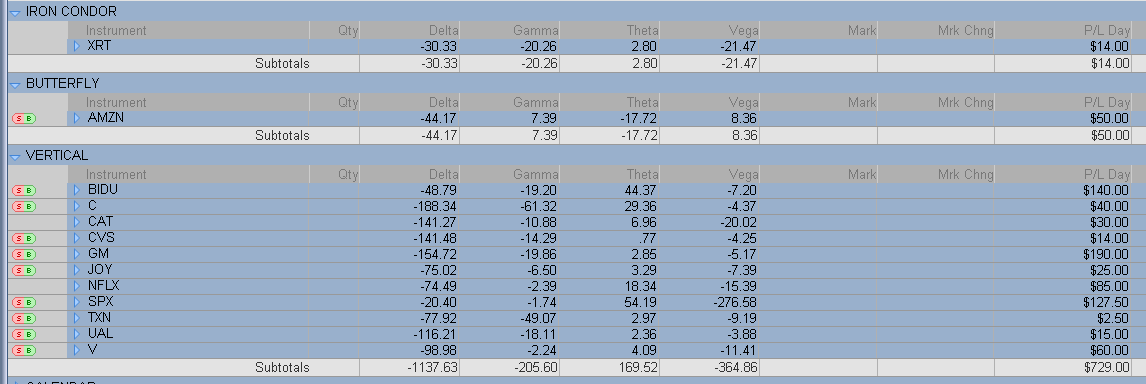

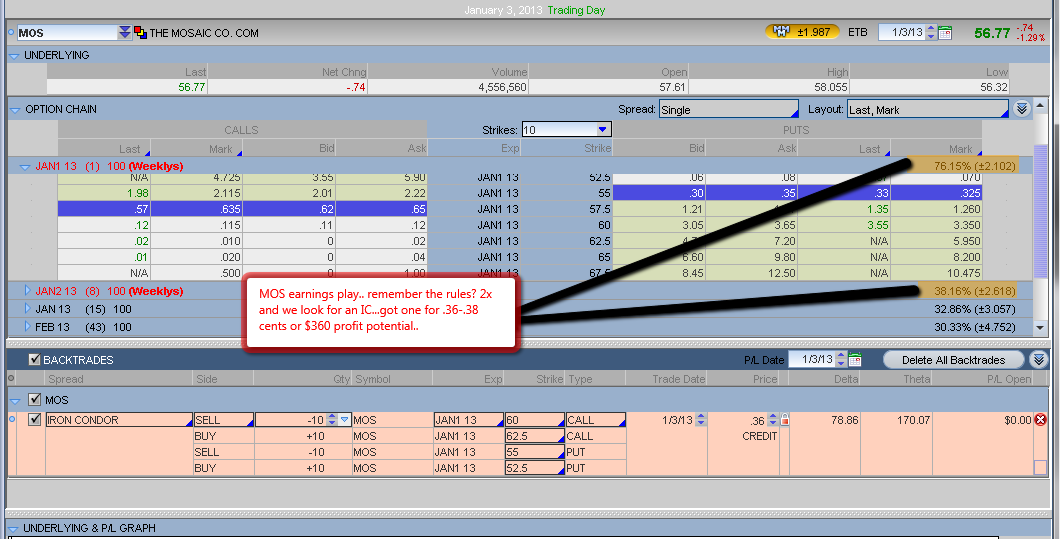

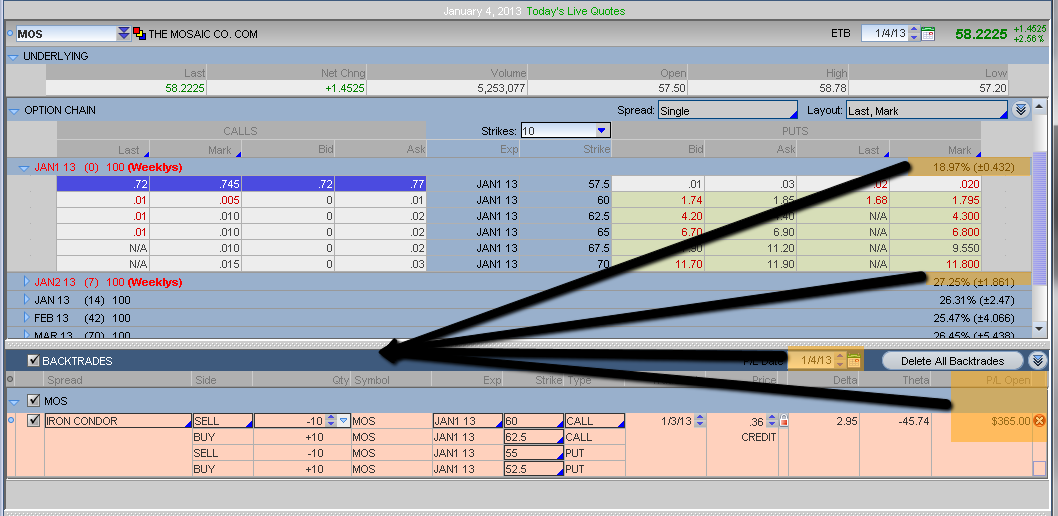

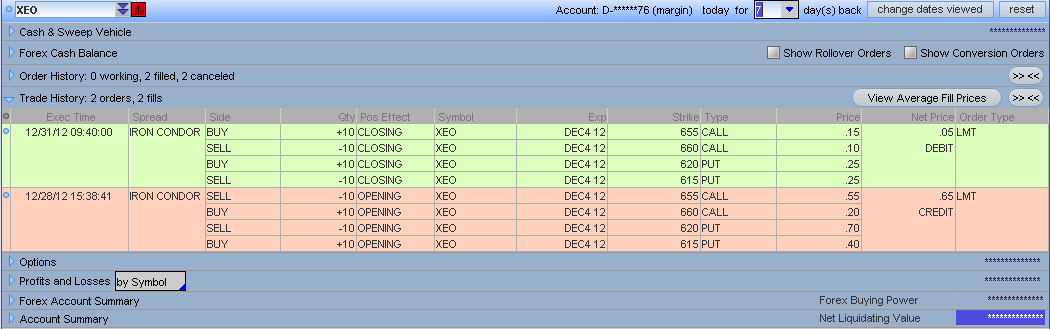

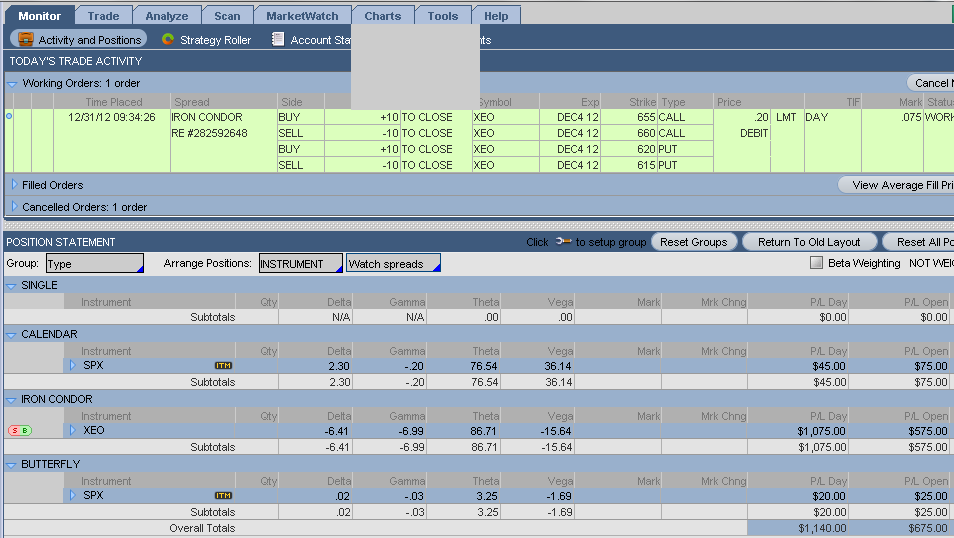

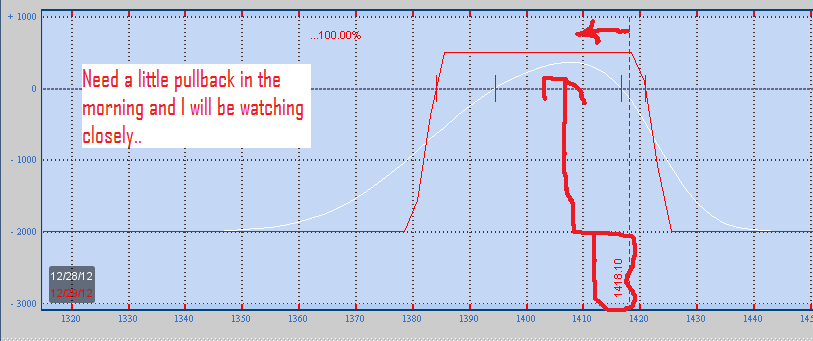

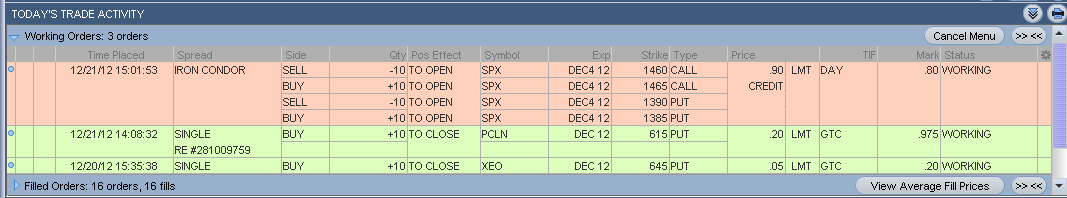

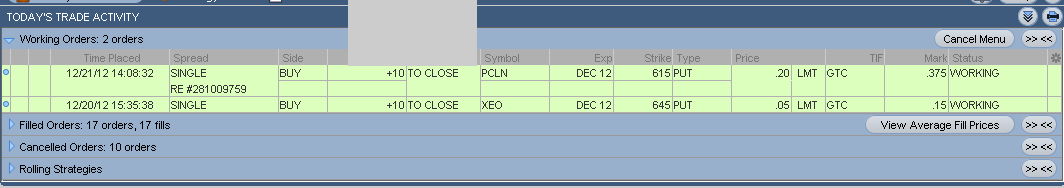

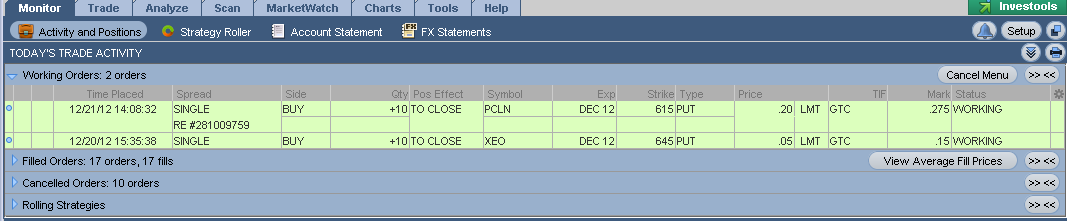

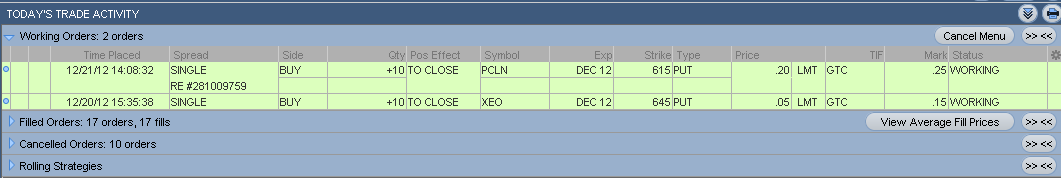

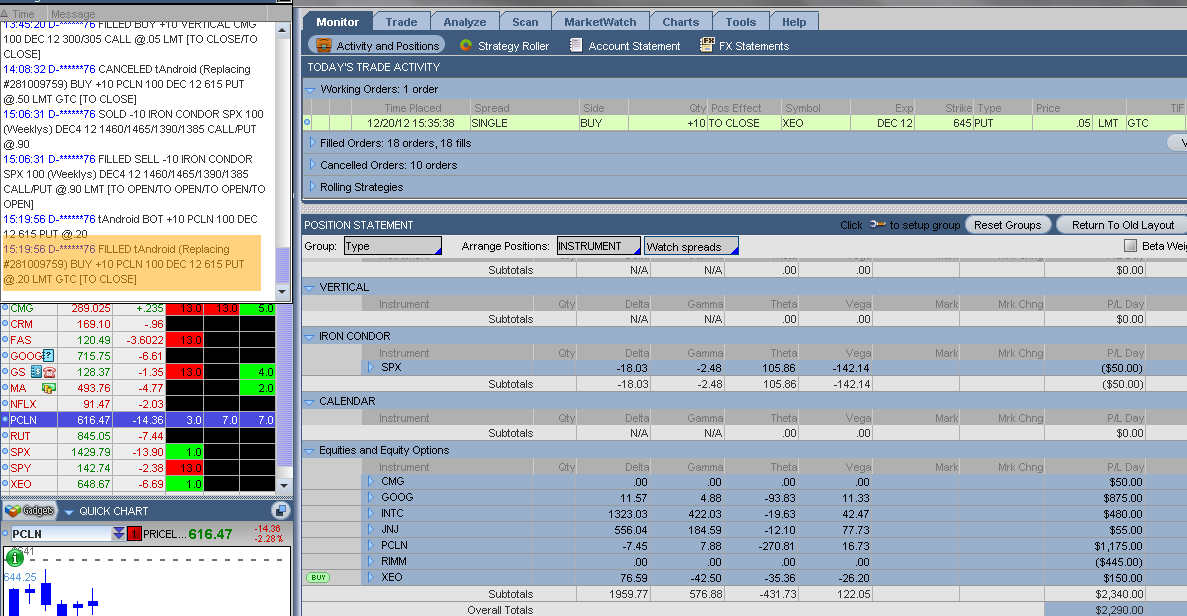

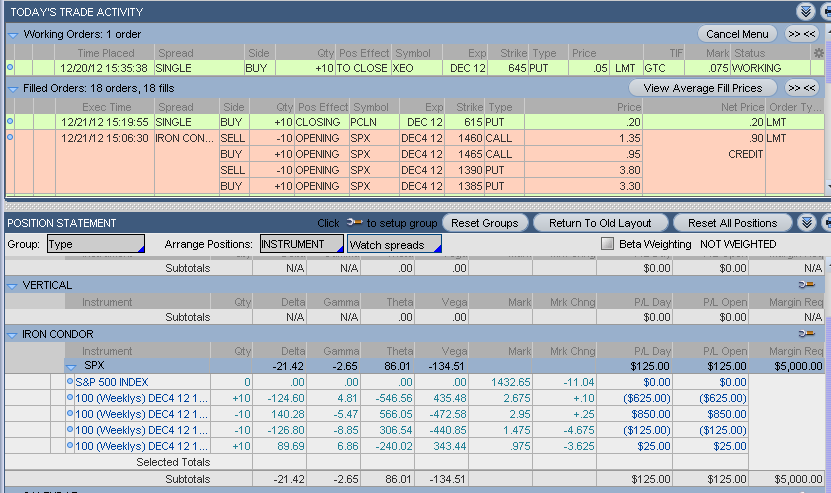

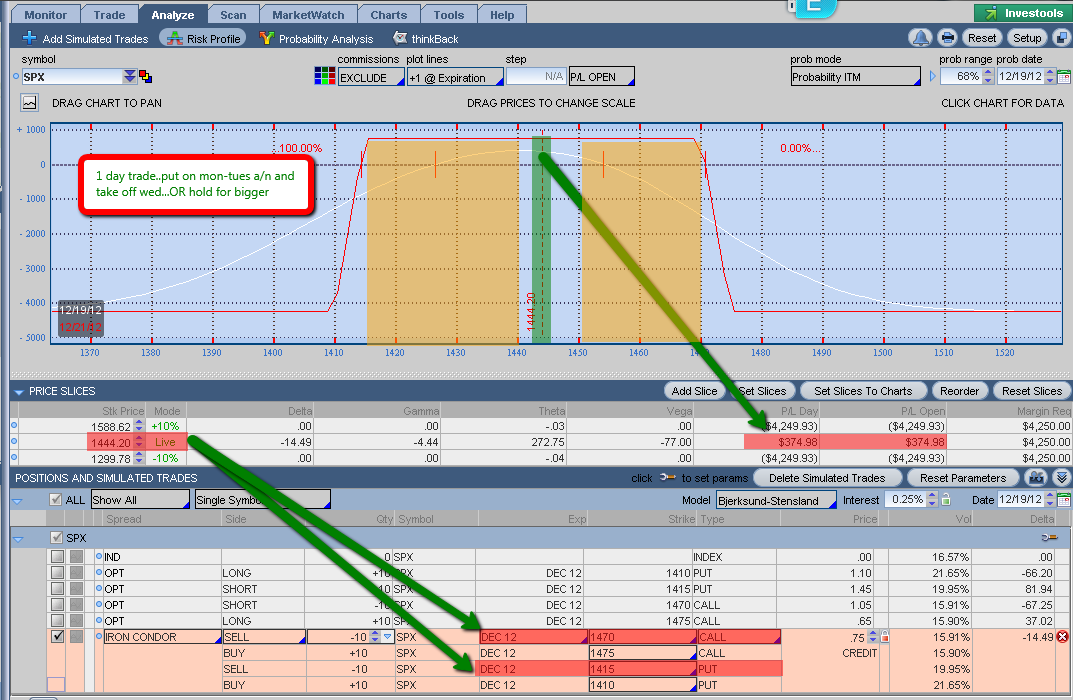

TEXTBOOK IC play as I teach it..look at the screen captures closely .. Friday, last hour of trading..all systems go!..Monday morning, off it comes..

12/28/2012

Overnight SPX iron condor closed for a nice profit going into the weekend..I will not be placing the weekly one today as the “fiscal cliff” junk until settled is not worth the risk..

12/262012

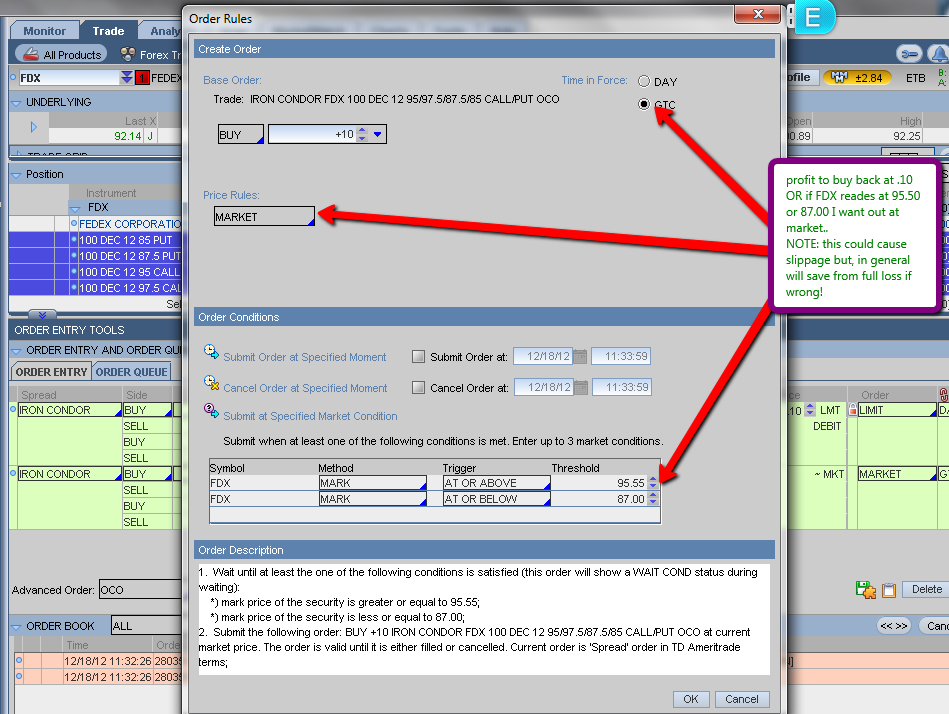

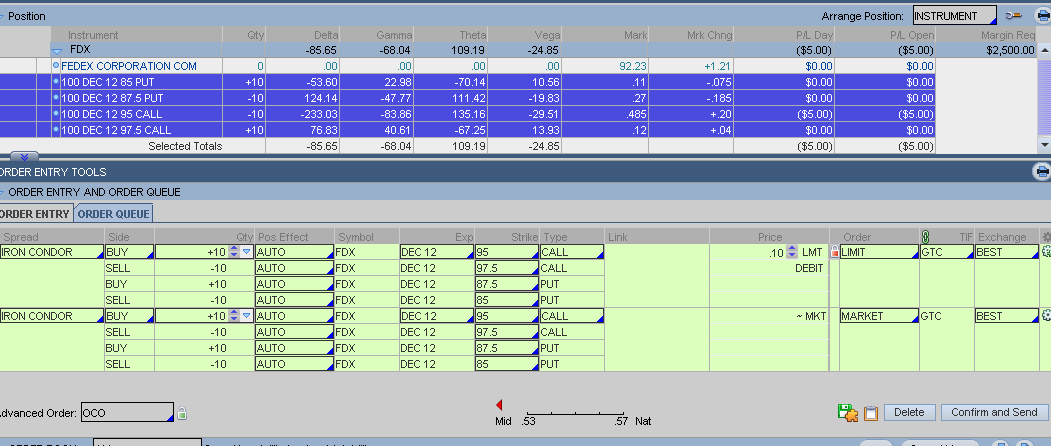

Trades for the short week..dipping in slightly with a couple verticals..NOTICE EXITS ARE ALREADY IN PLACE ..:)

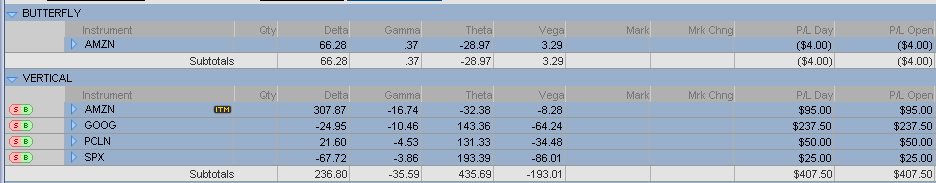

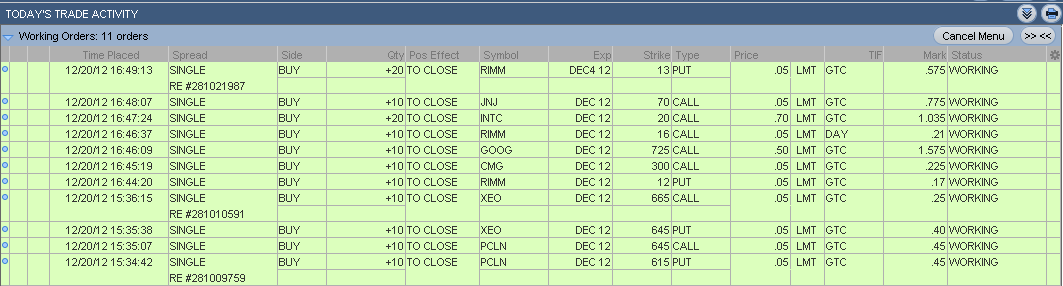

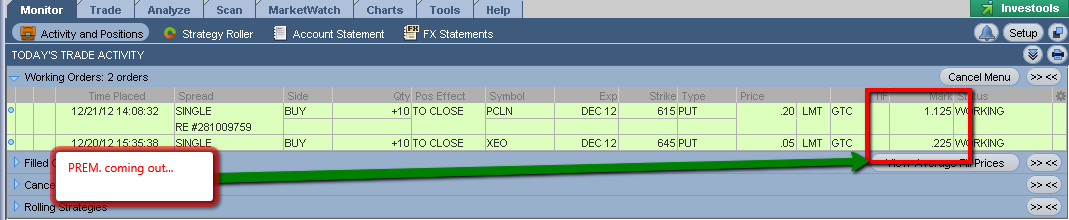

12/21/2012

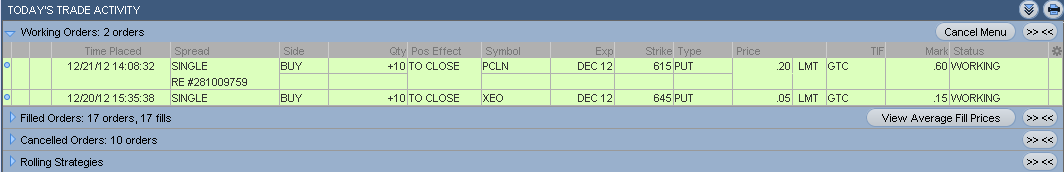

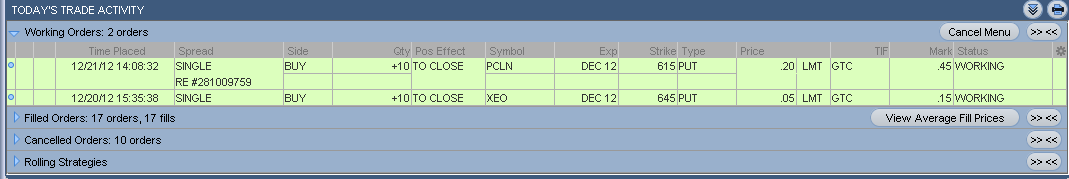

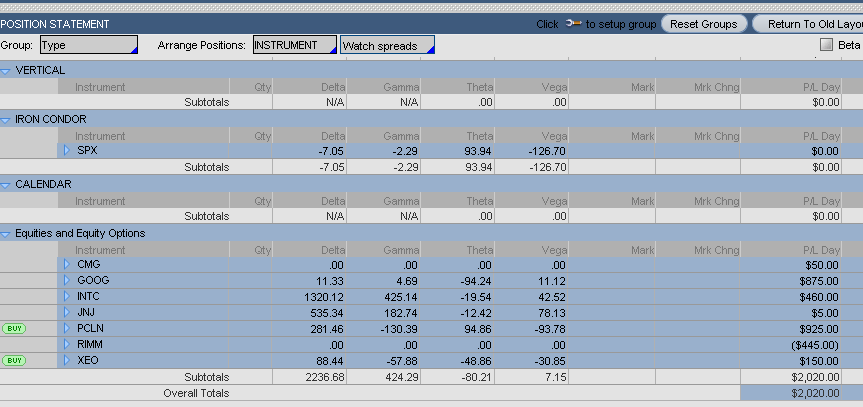

Wha a wild day..the news that the “fiscal cliff” deal fell apart overnight, sold off the /ES into a mini flash crash..our short PCLN 615 puts came under pressure and not knowing how time value (theta) works in relation to the charts will cause one to make “panic” decisions.. following are screen captures from the day..and how theta works..TRADE THE MATH and have confidence in it..

12/20/2012

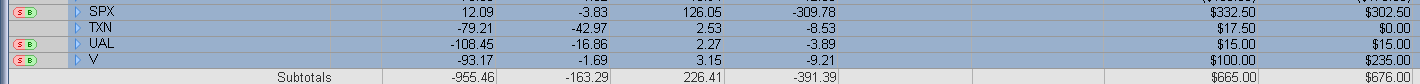

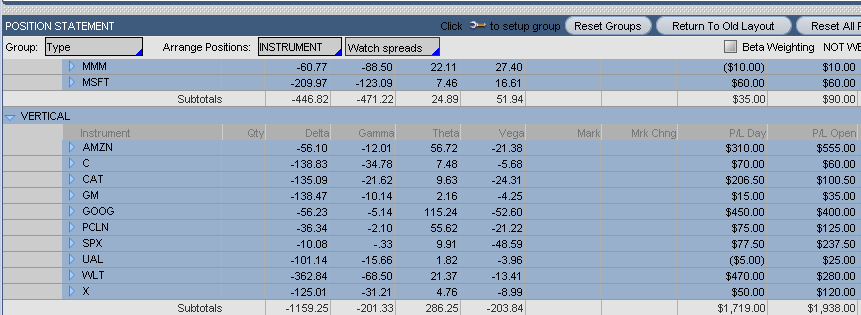

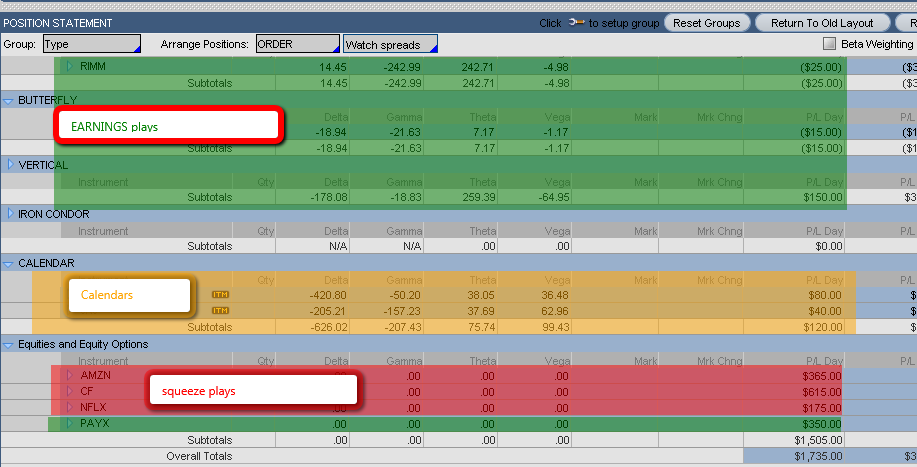

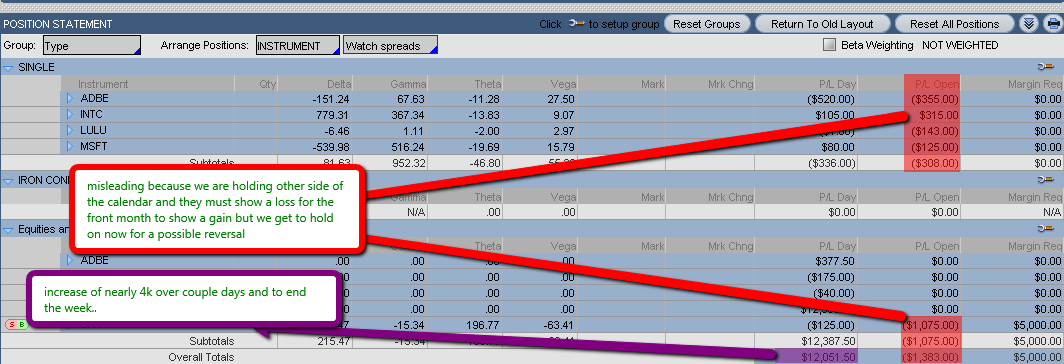

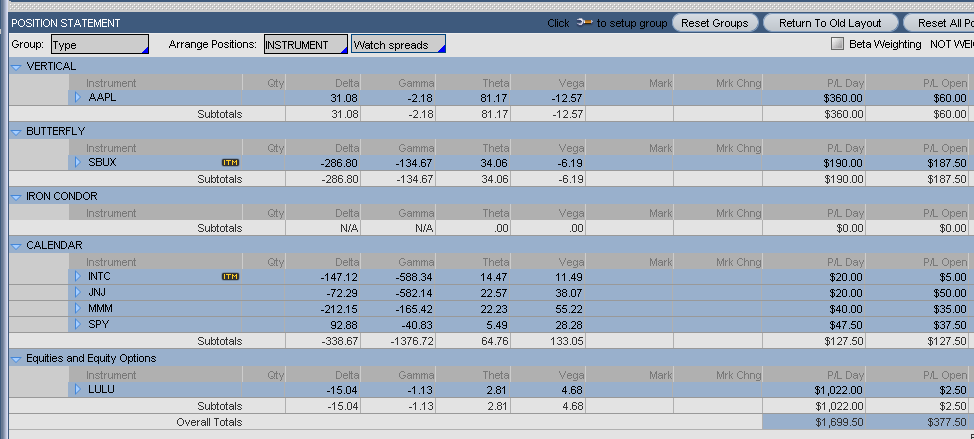

Partial results from earnings, squeezes and calendars..

12/19/2012

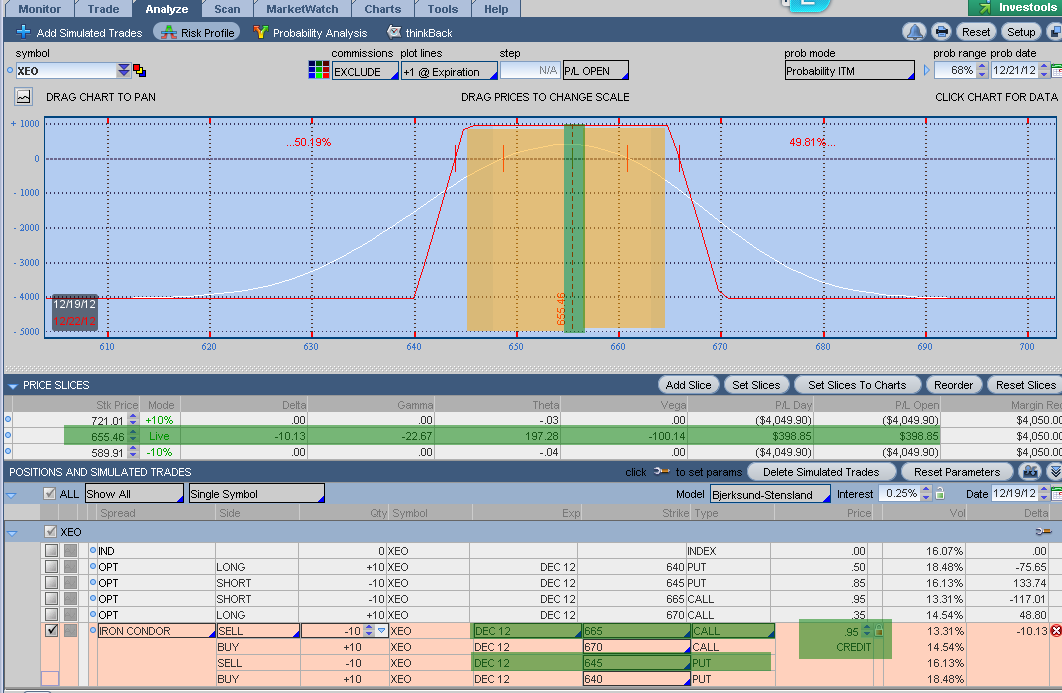

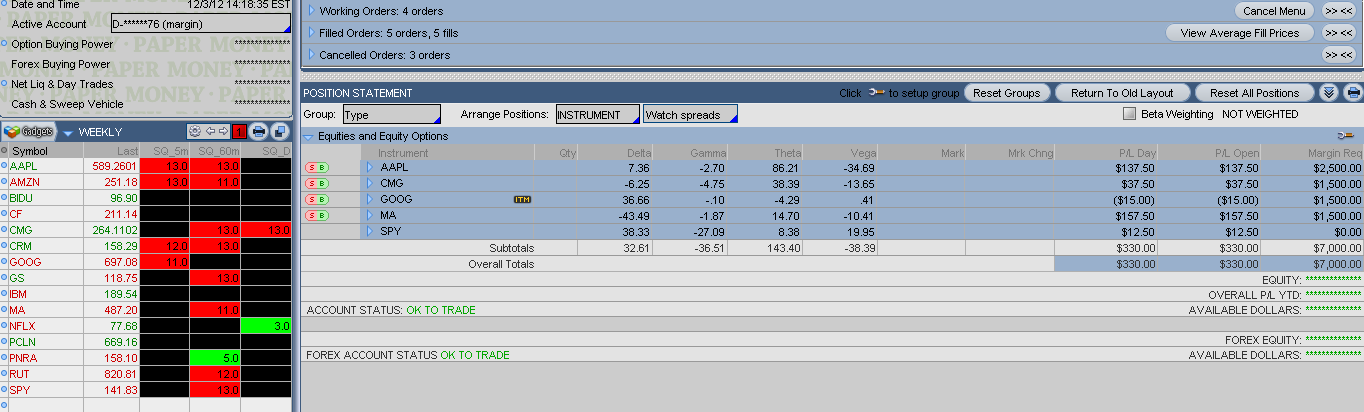

Example of webinar trades…

12/18/2012

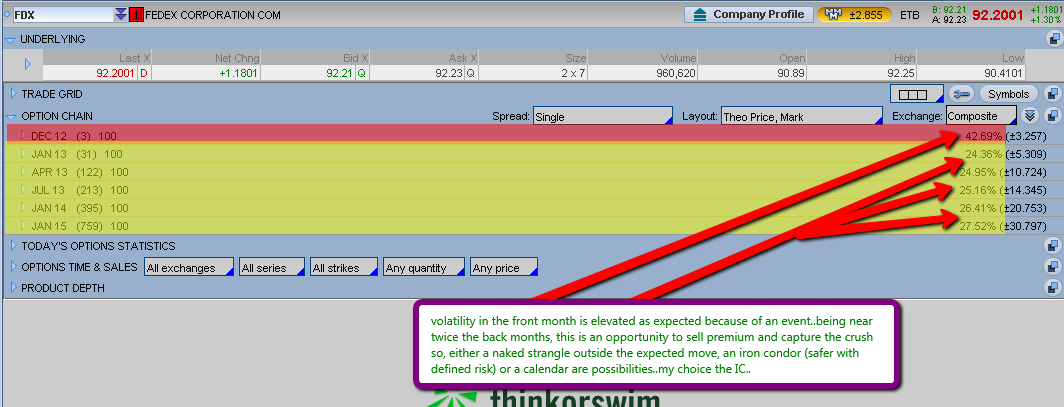

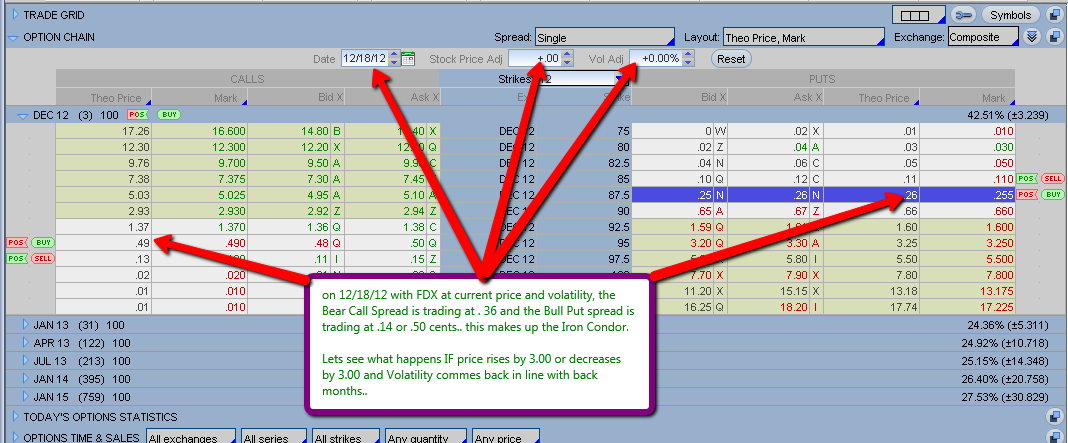

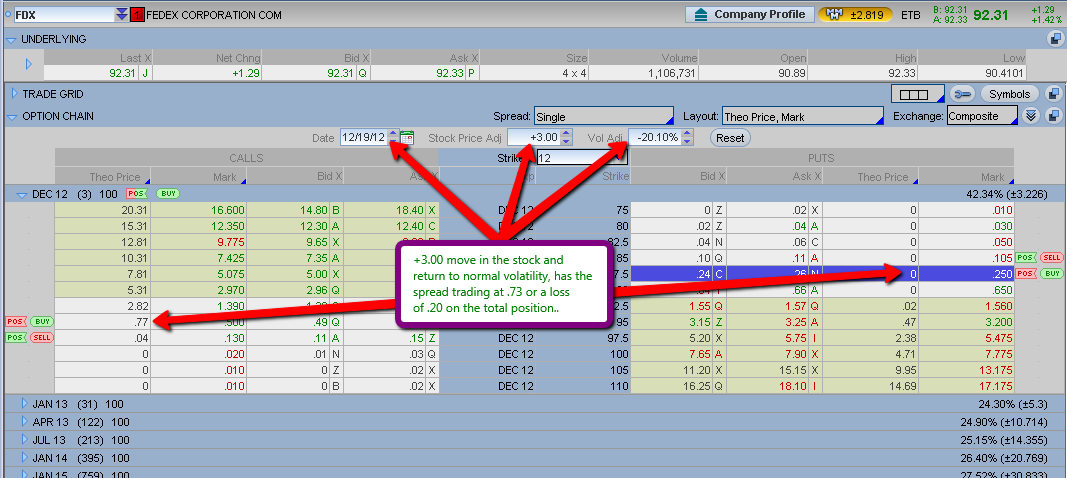

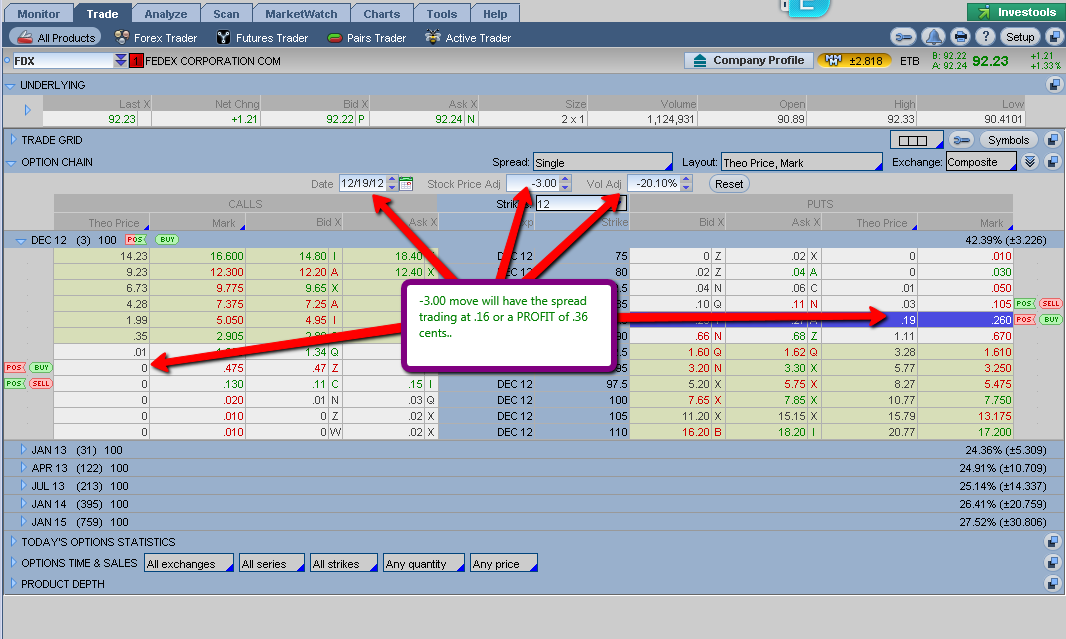

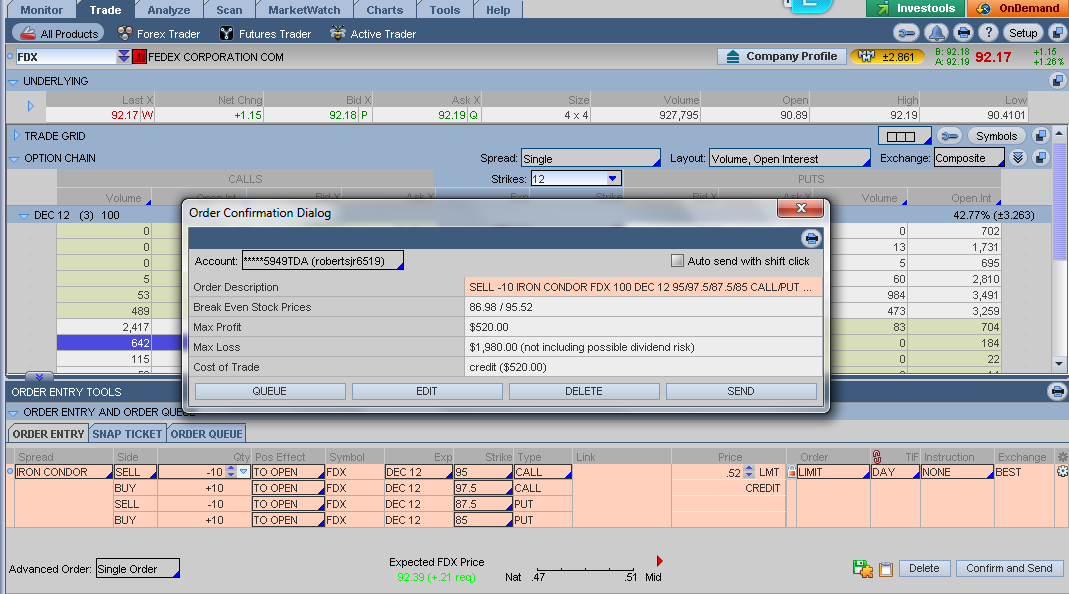

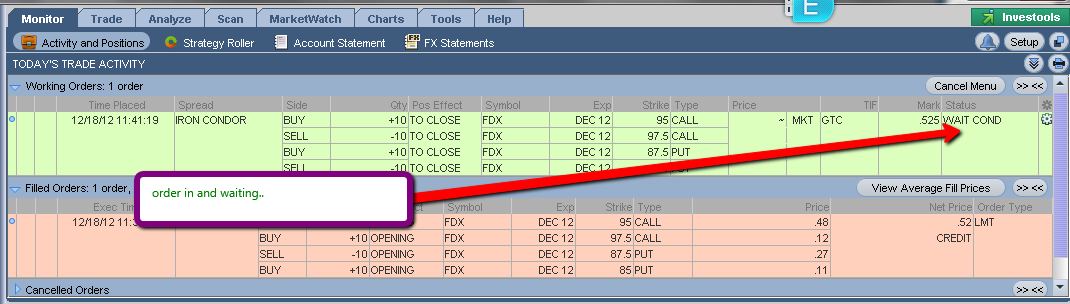

An example of vol crush with an earnings play on FDX..PLEASE READ THE CHARTS TO GET THE FULL BENEFITS..

Week ending..

Quick update..ADBE earnings and INTC calendar was closed for a couple nice winners..

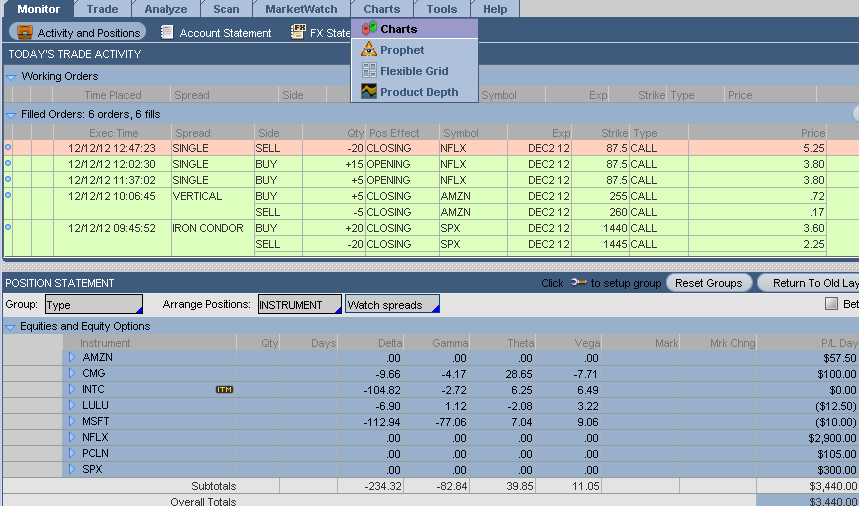

12/13/2012

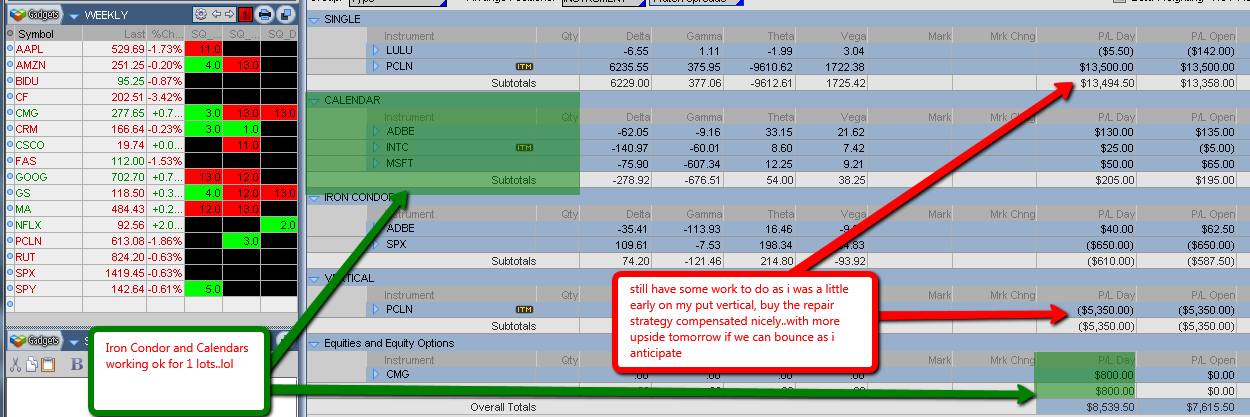

Crazy week with NFLX, AAPL and PCLN being the winners with hopefully a little more to come in PCLN tomorrow..we shall see…

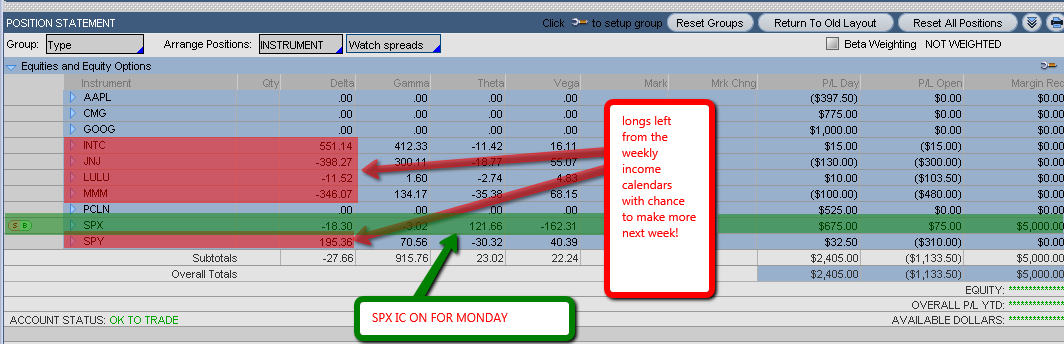

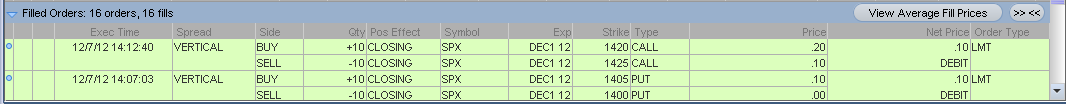

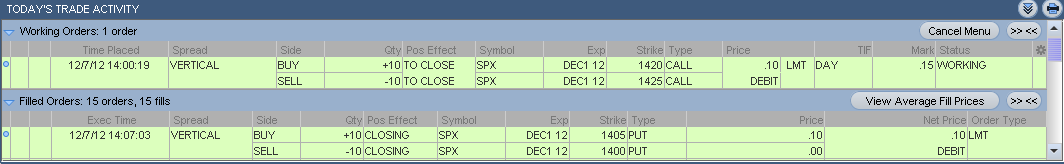

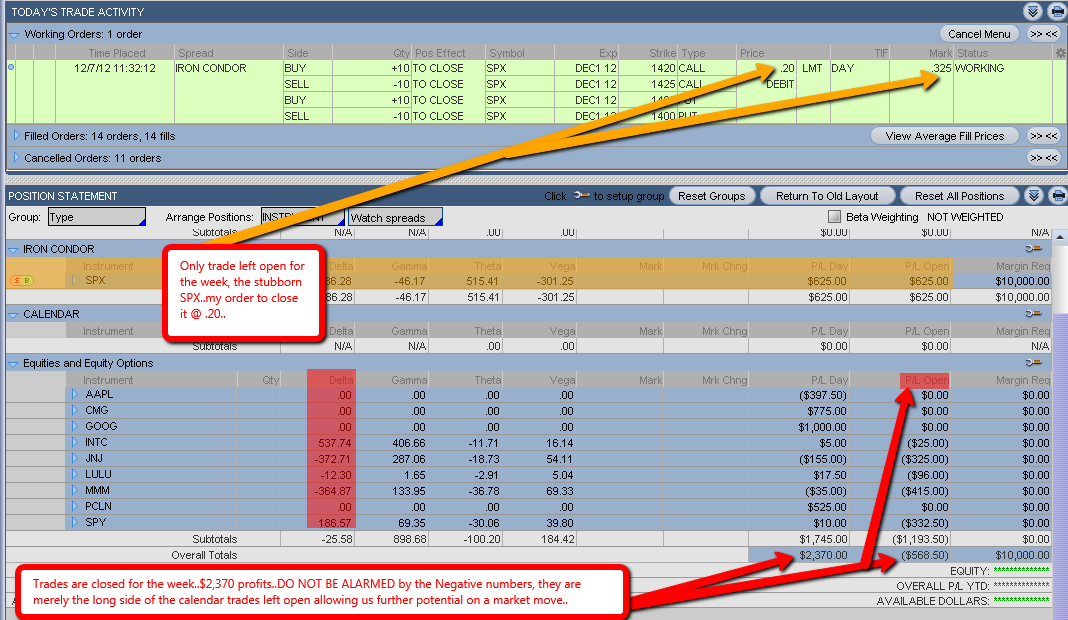

12/07/2012

Week finished…

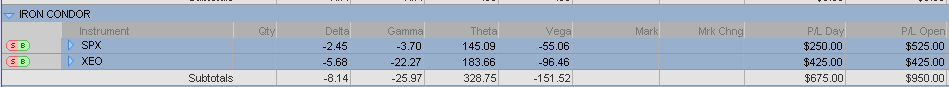

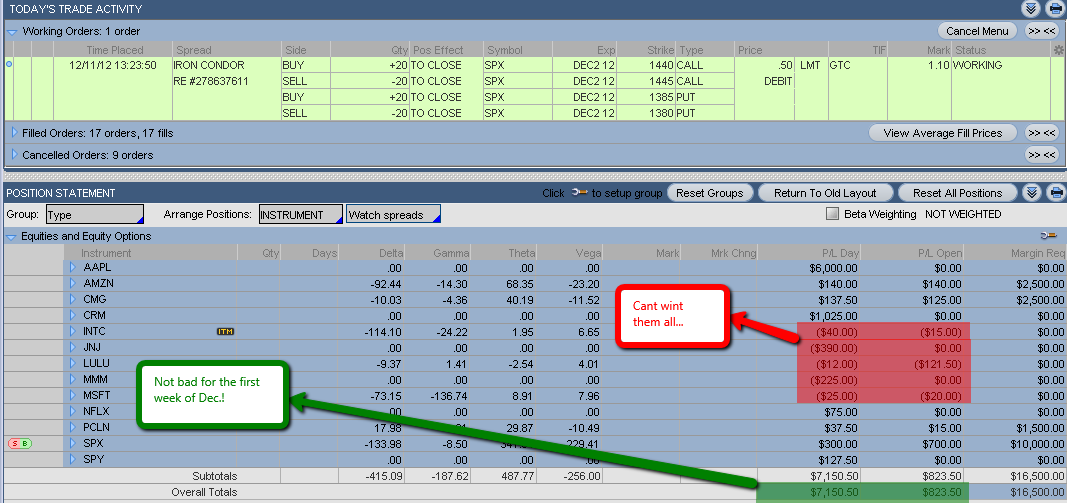

In the SPX, most times it is easier if the trade is broken up in legs, especially when trying to close a spread..here you can see, the put side was closed for my asking price and now just working the call side to end the week..

12//7/2012

12/6/2012

TRADE UPDATE for first week of December..

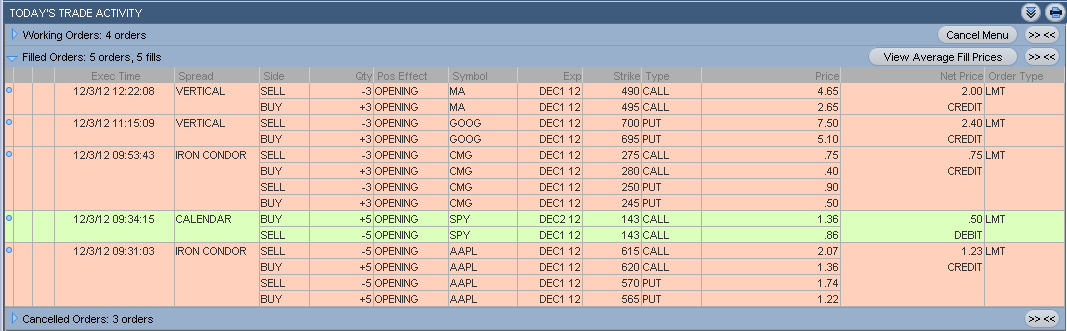

12/03/2012

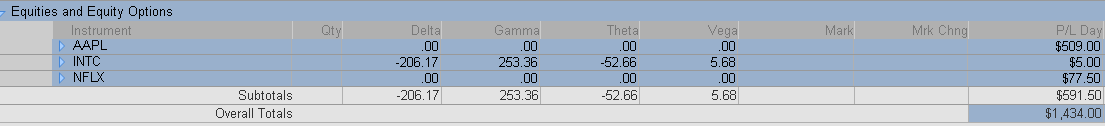

Here are my additional trades for December..an additional iron condor and two credit spreads..It is helpful to maintain a smaller list of tickers that move and trade them..

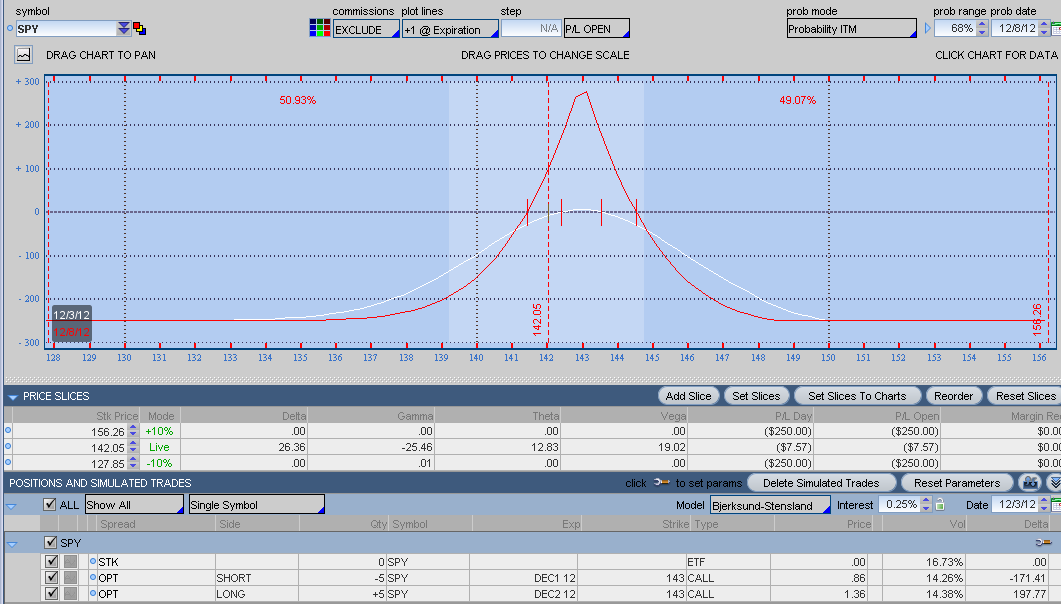

SPY CALL CALENDAR DEC1 143c

11//28/2012

On this page, I will introduce a lower stress/lower cost way to trade for income and account appreciation. I will be presenting my ideas on how I have found to make money in the markets that work for ME.

I will be trading options on a select few tickers that offer enough movement to collect premium by trading Credit Spreads, Iron Condors, an occasional Calendar and Butter Fly (Iron and straight up).

Why options? Options enable the trader to play the market in more subtle ways than buying or selling straight up allows. In addition, the smaller trader has the opportunity to play too.

Two things I want to say up front. First, THIS WORKS FOR ME and may NOT work for you and second, I am NOT the original author of many of these strategies, concepts and trading generalities. BUT, I have done EXTENSIVE RESEARCH, paid $$$’s of dollars for mentors, coaches, courses and trading rooms taking the best from each, testing and trading with my OWN money and over the last three years have narrowed it down to what I find works for me.

I will not be going over the very basics of options as there are thousands of free resources on the internet and I do not want to take up valuable space here with such content. When I introduce something that may be a little advanced or unusual, I will provide an explanation in my words of what I am doing and trying to accomplish.

Options allow me to more specifically define risk and use leverage. In these pages, I will give explanations as well as examples. As with all aspects of this page, I do this not so that you can do as I do exactly, but so that you can optimize your own trading knowledge, goals and decisions.

I am mostly a CREDIT SPREAD option trader. There are times, when I will take directional trades for specific events such as fed announcements, earnings or other scheduled events that may offer an “edge” and allow me to “play” out an assumption with limited risk in return for a VERY favorable reward.

Over the next few post, I will lay out the basic trades that I take and what they are. I will also define some things so that a new trader will not be lost. Finally, I will run an example portfolio of Credit Trades showing how one can systematically trade this way and if and when adjustments are made, they will be given as to why and how.

In closing, I am no trading guru. I have a job, a wife, three children (well one daughter and two chihuahua), a wonderful worship family and I trade in an effort to provide a future comfortable living for myself and family. I have worked very hard to find what works for me and if I can save one $$$$’s and lost time for we all have a FINITE time here and it should be as comfortable as we want it to be, I am satisfied.. I do ask if you find any of this valuable and make a buck or two, you consider paying a little of it forward by supporting you local SPCA with a blanket or two, a bag of food or something of that nature… 🙂

Lastly, I have been asked in the past by many friends and acquaintances that have observed my results to both mentor or provide a trade service while I have done a VERY limited amount of this, I don’t currently plan to offer those services due to obligations currently in my life..in the future, that may change but for now, this will keep me accountable and hopefully help some of you.