AMZN is testing the initial PRZ (Potential Reversal Zone aka a harmonic pattern’s completion zone) level at 377.99. Probability wise this sets up for a stall or pullback. How much this pulls back is key. Inside the world of harmonics, a hold below 374.36 has four downside targets for a support test, the first two at 364.85 and 349.38, then 342.59 and ideally 284 or lower, of course there are intermediate levels in between but these initial tests are what I’m looking for to gauge the strength of this bearish pattern. Just because a bearish pattern completes offers no guarantees of a swoosh reversal, it primarily offers an area of interest and a definite scaling point or profit protection for an existing long position.

If price continues to stall at the PRZ instead of pulling back into a retracement mode, then the probability is to test all levels inside the PRZ with 389.78 being the extreme. There’s a potential breach of 389.78 to test the double top at 408.06, what follows that scenario is important because there are much larger opposing emerging patterns in play and this 408.06 is the line in the sand. Above 408.06 has a symmetrical upside target of 525.03. But as long as price holds below 408.06, the opposing brown colored Bat has a chance, and that probability increases with each noted level failing to hold price up.

AMZN is pretty expanded at this 374.36, so it’ll be interesting to see how price interacts with this level in regards to stall or pullback mode.

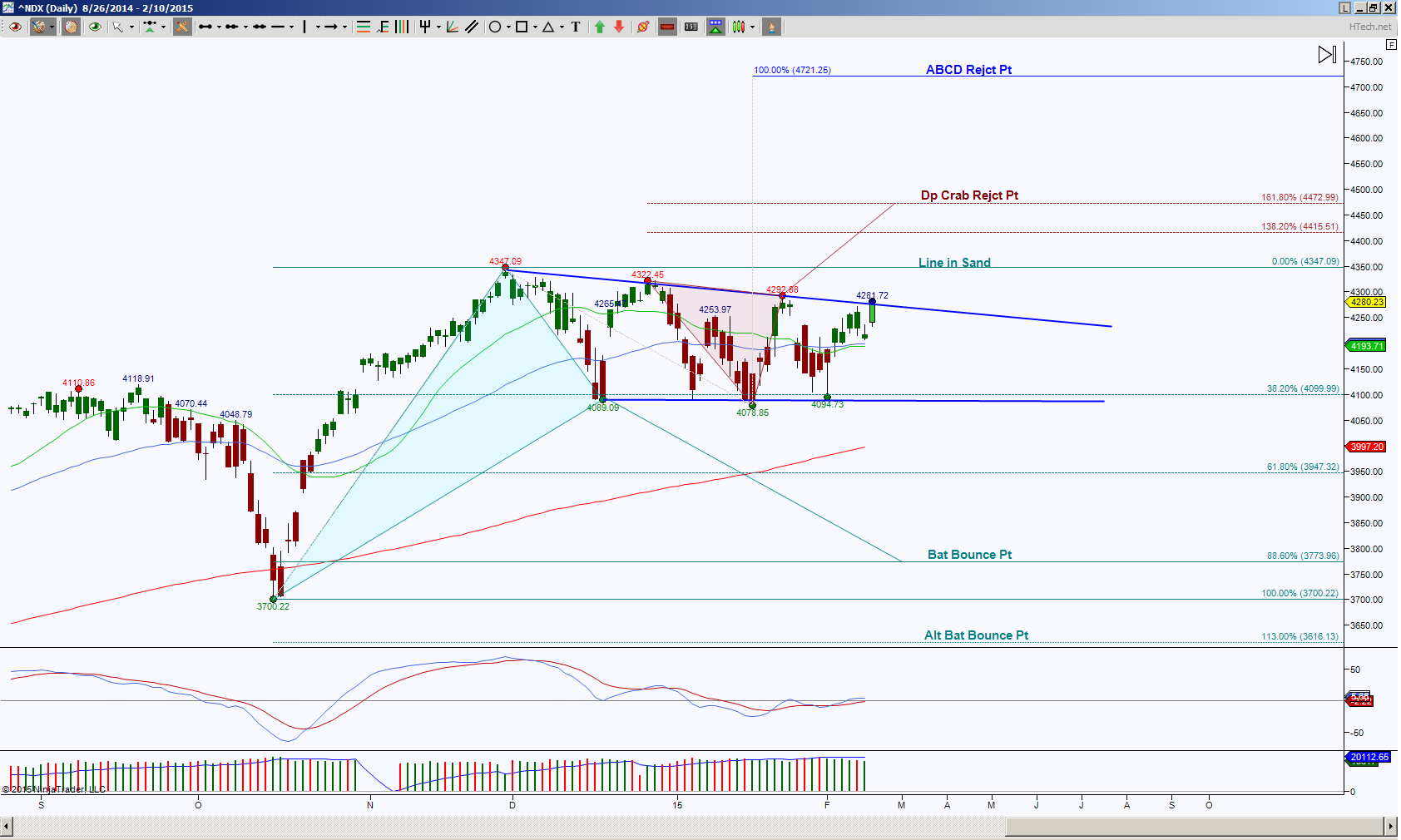

In comparison to the Nasdaq Index, I find it interesting that AMZN is testing a bearish PRZ while NDX is testing the top of its Pennant type consolidation. Price is at a decision point, to either stall, reject or push through an important resistance for both of these instruments. Understanding price action, risk management and probabilities is a must in trading, especially at decision points.

Trading involves substantial risk and is not suitable for all investors. Past performance is not indicative of future results.