GC Revised:

When intraday levels or patterns are exceeded or invalidated or you want more detailed analysis, please refer to charts posted for the week, click here

Futures Pattern Scanner by Neoharmonics:

ES_F has same scenario as for 5/9. Initial lvls to brk & hld are above 2392.5 or below 2389.75.

NQ_F completed teal ABCD as stipulated 5/9. Currently price is in between opposing emerging patterns w/ line in sand at 5687.75, as long as price holds below there, the green Bat remains in play w/ scaling pts at green GRZ lvls. Abv 5687.75 invalidates Bat & focuses on another ABCD at 5717.

CL_F green Bat has shifted to Gartley provided the AC trendline holds as resist but preferably want to see price hold back below 46.18 then more important 45.73 for Gartley scenario. Above the trendline does have the brown Bat PRZ at 47.61 as up tgt. Note strg8 has retrced Alt Bat a bit of 50%, where price can brk & hld outside of GRZ is key.

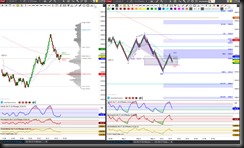

GC_F had great Shark to 5-0 scenario. Now looking to see a return to 1217.5 or abv GRZ 1222.9 to take another shot at retracing that Shark to upside. Day chart shows important sup tests in regards to another Shark formation.

Have a question about an instrument not listed? Just ask me.

Trading involves substantial risk and is not suitable for all investors. Past performance is not indicative of future results.