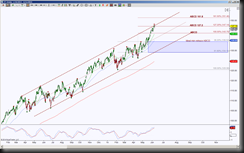

The ETF for Dow Jones Transportation has been in an uptrend since November 2012 and in an uptrend channel since March 2013 and is currently testing the extreme of the channel resistance trendline accompanied by a measured move extension Fibonacci level at 147.14.

The day chart is the visual of this confluence resistance test and the upside red dot implies that the most recent impulsive move from the downside green dot at 134.45, has completed. And if we factor in the fact that there are two means of resistance that merge at 147.14, it increases the probability of a stall or pull back into support. Note that price breached the channel line but fell back inside the channel. The ideal minimum pull back target is 143.75, failure to get there increases the probability of sideways range, unless of course, price shoots higher beyond the confluence resistance.

The day chart is the visual of this confluence resistance test and the upside red dot implies that the most recent impulsive move from the downside green dot at 134.45, has completed. And if we factor in the fact that there are two means of resistance that merge at 147.14, it increases the probability of a stall or pull back into support. Note that price breached the channel line but fell back inside the channel. The ideal minimum pull back target is 143.75, failure to get there increases the probability of sideways range, unless of course, price shoots higher beyond the confluence resistance.

The idea of a channel is that it is a means of parameters that measures a range, this particular range has held the price inside of it for over a year. Since this is already an uptrend channel, if price closes and holds, key is the word “holds”, above the channel, that is making quite the statement regarding the upside bias.

Looking at a smaller view, an intraday perspective, I’ve chosen an STRenko 20 bar size, it shows there was a reason for the daily breach of the channel trendline, to test the bearish pattern PRZ at 184.17.

Looking at a smaller view, an intraday perspective, I’ve chosen an STRenko 20 bar size, it shows there was a reason for the daily breach of the channel trendline, to test the bearish pattern PRZ at 184.17.

This bearish pattern, called a Deep Crab, has retraced approximately 50% (this fibs are not shown), this is a respectable retracement, but since the ideal retracement target for most harmonic patterns is 100%, this is considered a shallow retracement. However, there is a new emerging pattern, a bullish Gartley that is currently in formation and the completion of this pattern at 145.70 or even the extended targets as noted on the chart, will help that bearish pattern test lower retracement targets.

The initial levels to break and hold are either 147.40 or 146.92, the direction of the break will offer higher probability of targets noted on the chart. Upside break implies a retest of the PRZ as shown in the red rectangle, with a point of interest at 147.74. Upside continuation has the extension targets of 148.73 and 149.44.

A downside break of 146.92 increases the probability of completing the Gartley with an intermediate important support test at 146.23. What occurs at this 145.70 target will be important because it has the capability of being a rejection point to spur upside move, but if price cannot bounce or move higher than 164.23, that is a sign of weakness and increases the probability of sideways range or reaching for the downside targets of 144.16 and 143.07 and points of interest at the blue fibs.

Notice the extended targets on the intraday chart will help price pull back to its day chart’s ideal minimum target of 143.75.